by Calculated Risk on 2/01/2014 11:15:00 AM

Saturday, February 01, 2014

Schedule for Week of Feb 2nd

This will be a busy week for economic data with several key reports including the January employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, January vehicle sales also on Monday, the ISM service index on Wednesday, and the December trade deficit report on Thursday.

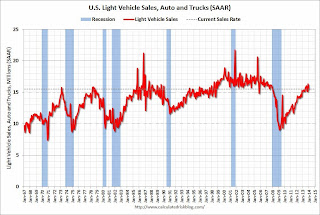

All day: Light vehicle sales for January. The consensus is for light vehicle sales to increase to 15.7 million SAAR in January (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in December.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to increase to 15.7 million SAAR in January (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in December.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

9:00 AM ET: The Markit US PMI Manufacturing Index for January. The consensus is for a decrease to 53.9 from 55.0 in December.

10:00 AM ET: ISM Manufacturing Index for January. The consensus is for a decrease to 56.0 from 57.0 in December.

10:00 AM ET: ISM Manufacturing Index for January. The consensus is for a decrease to 56.0 from 57.0 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in December at 57.0%. The employment index was at 56.9%, and the new orders index was at 64.2%.

10:00 AM: Construction Spending for December. The consensus is for no change in construction spending.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 1.8% decrease in December orders.

10:00 AM: The Congressional Budget Office will release its annual Budget and Economic Outlook. The report will include updated economic and budget projections spanning the period from 2014 to 2024.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in January, down from 238,000 in December.

10:00 AM: ISM non-Manufacturing Index for January. The consensus is for a reading of 53.9, up from 53.0 in December. Note: Above 50 indicates expansion, below 50 contraction.

Early: Trulia Price Rent Monitors for January. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 337 thousand from 348 thousand.

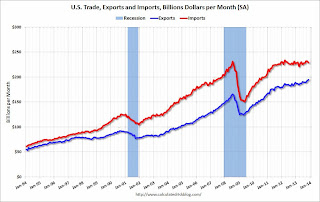

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. Imports decreased, and exports increased in November.

The consensus is for the U.S. trade deficit to increase to $36.0 billion in December from $34.3 billion in November.

8:30 AM: Employment Report for January. The consensus is for an increase of 181,000 non-farm payroll jobs in January, up from the 74,000 non-farm payroll jobs added in December.

The consensus is for the unemployment rate to be unchanged at 6.7% in January.

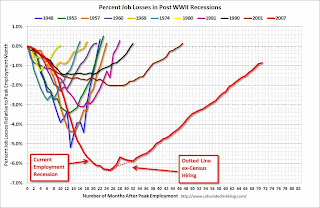

The following graph shows the percentage of payroll jobs lost during post WWII recessions through December.

The economy has added 8.2 million private sector jobs since employment bottomed in February 2010 (7.6 million total jobs added including all the public sector layoffs).

The economy has added 8.2 million private sector jobs since employment bottomed in February 2010 (7.6 million total jobs added including all the public sector layoffs).There are still almost 640 thousand fewer private sector jobs now than when the recession started in 2007.

3:00 PM: Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $12.0 billion in December.