by Calculated Risk on 4/29/2014 09:00:00 AM

Tuesday, April 29, 2014

Case-Shiller: Comp 20 House Prices increased 12.9% year-over-year in February

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Defy Weak Sales Numbers According to the S&P/Case-Shiller Home Price Indices

Data through February 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the annual rates of gain slowed for the 10-City and 20-City Composites. The Composites posted 13.1% and 12.9% in the twelve months ending February 2014.

Both Composites remained relatively unchanged month-over-month. Thirteen of the twenty cities declined in February. Cleveland had the largest decline of 1.6% followed by Chicago and Minneapolis at -0.9%. Las Vegas posted -0.1%, marking its first decline in almost two years. Tampa showed its largest decline of 0.7% since January 2012.

“Prices remained steady from January to February for the two Composite indices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The annual rates cooled the most we’ve seen in some time. The three California cities and Las Vegas have the strongest increases over the last 12 months as the West continues to lead. Denver and Dallas remain the only cities which have reached new post-crisis price peaks. The Northeast with New York, Washington and Boston are seeing some of the slowest year-over-year gains. However, even there prices are above their levels of early 2013. On a month-to-month basis, there is clear weakness. Seasonally adjusted data show prices rose in 19 cities, but a majority at a slower pace than in January.

Click on graph for larger image.

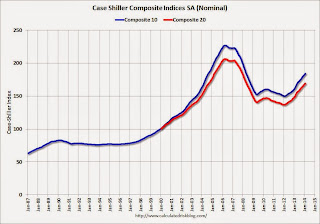

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.9% from the peak, and up 0.9% in February (SA). The Composite 10 is up 22.8% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 18.1% from the peak, and up 0.8% (SA) in February. The Composite 20 is up 23.4% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.1% compared to February 2013.

The Composite 20 SA is up 12.9% compared to February 2013.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in February seasonally adjusted. (Prices increased in 7 of the 20 cities NSA) Prices in Las Vegas are off 44.5% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was at the consensus forecast for a 13.0% YoY increase. I'll have more on prices later.