by Calculated Risk on 4/01/2014 09:09:00 AM

Tuesday, April 01, 2014

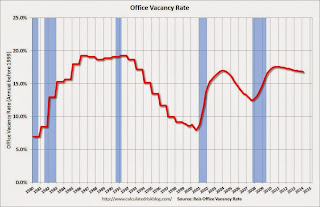

Reis: Office Vacancy Rate declined slightly in Q1 to 16.8%

Reis released their Q1 2014 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.8% in Q1. This is down from 16.9% in Q4 2013, and down from the cycle peak of 17.6%.

From Reis Senior Economist Ryan Severino:

The national vacancy rate was down 10 basis points during the fourth quarter to 16.8%. This is a very marginal improvement from last quarter, but completely in line with the tepid recovery in the office sector since it commenced in early 2011. Since that, time declines in vacancy have been no greater than 10 basis points per quarter; the vacancy rate has been unchanged in numerous quarters during the recovery. Over the last twelve months, the vacancy rate is down just 20 basis points, on par with last quarter. National vacancies remain elevated at 430 basis points above the sector's cyclical low of 12.5% recorded during the third quarter of 2007.On absorption and new construction:

emphasis added

Net absorption increased by 9.8 million square feet during the quarter. This is the highest quarterly figure since before the recession. Net absorption averaged roughly 7.1 million square feet per quarter during 2013 so this represents an optimistic start to the year. Construction increased by 6.3 million square feet during the first quarter. This is roughly on par with the quarterly average of 6.5 million square feet during 2013. Therefore, net absorption outpaced completions by approximately 3.5 million square feet during the first quarter. This is heartening because in recent quarters increases in net absorption have been largely tied to increases in construction activity. This is a more organic increase, tied to increasing demand for existing inventory as well as newly completed space.On rents:

Asking and effective rents grew by 0.7% and 0.8%, respectively, during the first quarter. These figures are all little changed from last quarter, owing to the similar tepid pace of improvement in vacancy. Nevertheless, asking and effective rents have now risen for fourteen consecutive quarters, albeit modestly. Asking rent growth was 1.6% during 2011, 1.8% during 2012, and 2.1% in 2013. Given the still‐elevated national vacancy rate, rent growth is struggling to grow faster than inflation because landlords have little leverage over tenants.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged at 16.8% in Q1, and was down from 17.0% in Q1 2013. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

Office vacancy data courtesy of Reis.