This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities) and the Q1 National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Rise in March According to the S&P/Case-Shiller Home Price Indices

Data through March 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... show the 10-City and 20-City Composite Indices gained 0.8% and 0.9% month-over-month. In the first quarter of 2014, the National Index gained 0.2%. Nineteen of the 20 cities showed positive returns in March – New York was the only city to decline. Dallas and Denver reached new index peaks.

In March, the National and Composite Indices saw their annual rates of gain slow significantly. ... The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 10.3% gain in the first quarter of 2014 over the first quarter of 2013. The 10- and 20-City Composites posted year-over-year increases of 12.6% and 12.4% in March 2014.

“The year-over-year changes suggest that prices are rising more slowly,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Annual price increases for the two Composites have slowed in the last four months and 13 cities saw annual price changes moderate in March. The National Index also showed decelerating gains in the last quarter. Among those markets seeing substantial slowdowns in price gains were some of the leading boom-bust markets including Las Vegas, Los Angeles, Phoenix, San Francisco and Tampa.

“Despite signs of decelerating prices, all cities were higher than a year ago and all but New York were higher in March than in February. However, only Denver and Dallas have set new post-crisis highs and they experienced relatively lower peak levels than other cities. Four locations are fairly close to their previous highs: Boston (8%), Charlotte (9%), Portland (13%) and San Francisco (15%).

Click on graph for larger image.

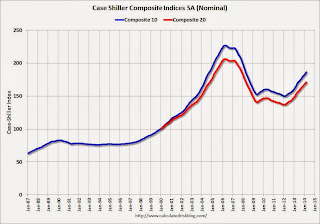

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 17.8% from the peak, and up 1.2% in March (SA). The Composite 10 is up 24.3% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.0% from the peak, and up 1.2% (SA) in March. The Composite 20 is up 25.0% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 12.6% compared to March 2013.

The Composite 20 SA is up 12.4% compared to March 2013.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in March seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 43.8% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was above the consensus forecast for a 11.9% YoY increase. I'll have more on house prices later.