by Calculated Risk on 5/01/2014 10:29:00 AM

Thursday, May 01, 2014

Construction Spending increased 0.2% in March, Public Construction Spending Lowest since 2006

The Census Bureau reported that overall construction spending increased in March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2014 was estimated at a seasonally adjusted annual rate of $942.5 billion, 0.2 percent above the revised February estimate of $940.8 billion. The March figure is 8.4 percent above the March 2013 estimate of $869.2 billion.Private spending increased and public spending decreased in March:

Spending on private construction was at a seasonally adjusted annual rate of $679.6 billion, 0.5 percent above the revised February estimate of $676.3 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $262.9 billion, 0.6 percent below the revised February estimate of $264.5 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 45% below the peak in early 2006, and up 62% from the post-bubble low.

Non-residential spending is 25% below the peak in January 2008, and up about 38% from the recent low.

Public construction spending is now 19% below the peak in March 2009 and at a new post-recession low.

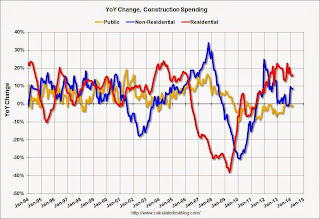

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 16%. Non-residential spending is up 8 year-over-year. Public spending is down 1% year-over-year.

Looking forward, all categories of construction spending should increase in 2014. Residential spending is still very low, non-residential is starting to pickup, and public spending is probably near a bottom.

Note: Public construction spending is at the lowest level since 2006 (lowest since 2001 adjusted for inflation). Not investing more in infrastructure is probably one of the major policy failures of the last 5+ years.