by Calculated Risk on 5/15/2014 01:48:00 PM

Thursday, May 15, 2014

Earlier: Philly and NY Fed Manufacturing Surveys suggest Solid Expansion in May

From the Philly Fed: May Manufacturing Survey

The diffusion index of current general activity decreased slightly from a reading of 16.6 in April to 15.4 this month. The index has remained positive for three consecutive months, following the weather‐influenced negative reading in February.This was above the consensus forecast of a reading of 12.5 for May.

...

Indicators suggest slightly improved labor market conditions this month. The employment index remained positive for the 11th consecutive month but increased only 1 point [to 7.8].

emphasis added

From the NY Fed: Empire State Manufacturing Survey

Business conditions improved significantly for New York manufacturers, according to the May 2014 survey. On the heels of a rather weak reading of just 1.3 in April, the general business conditions index shot up eighteen points to 19.0, its highest level since mid-2010. ...This was well above the consensus forecast of 5.0

Employment expanded significantly; although the average workweek index held steady at 2.2, the index for number of employees rose thirteen points to 20.9. Indexes for the six-month outlook were highly optimistic, with the future general business conditions index rising to 44.0, its highest level in more than two years.

Click on graph for larger image.

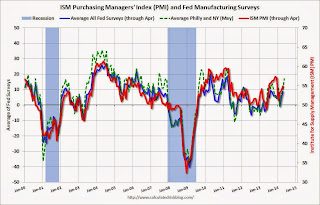

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys is at the highest level since 2011, and this suggests stronger expansion in the ISM report for May.