by Calculated Risk on 5/15/2014 10:00:00 AM

Thursday, May 15, 2014

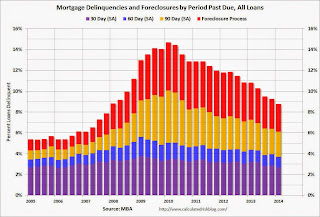

MBA: "Delinquency and Foreclosure Rates Continue to Improve" in Q1

From the MBA: Delinquency and Foreclosure Rates Continue to Improve

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.11 percent of all loans outstanding at the end of the first quarter of 2014, the lowest level since the fourth quarter of 2007. The delinquency rate decreased 28 basis points from the previous quarter, and 114 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 2.65 percent, down 21 basis points from the fourth quarter and 90 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the first quarter of 2008.

The percentage of loans on which foreclosure actions were started during the first quarter fell to 0.45 percent from 0.54 percent, a decrease of nine basis points, and the lowest level since the second quarter of 2006.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 5.04 percent, a decrease of 37 basis points from last quarter, and a decrease of 135 basis points from the first quarter of last year. Similar to the previous quarter, 75 percent of seriously delinquent loans were originated in 2007 and earlier, with another 20 percent originated between 2008 and 2010. Loans originated in 2011 and later only accounted for five percent of all seriously delinquent loans.

“We are seeing sustained and significant improvement in overall mortgage performance,” said Mike Fratantoni, MBA’s Chief Economist. “A more stable and stronger job market, coupled with strong credit standards on new loans, has kept delinquency rates on recent vintages low, while the portfolio of loans made pre-crisis is steadily being resolved. Increasing home prices, caused by tight inventories of homes for sale, have helped build an equity cushion for many new borrowers and have helped some homeowners who had been underwater regain positive equity in their properties. The increase in values also helps to facilitate sales of distressed properties, which may further expedite the pace of resolution of pre-crisis loans.”

“Judicial states continue to account for the majority of loans in foreclosure, making up almost 70 percent of loans in foreclosure, while only representing about 40 percent of loans serviced. Of the 17 states that had a higher foreclosure inventory rate than the national average, 15 of those were judicial states. While the percentages of loans in foreclosure dropped in both judicial and non-judicial states, the average rate for judicial states was 4.6 percent compared to the average rate of 1.4 percent for non-judicial states.

“New Jersey, a state with a judicial foreclosure system, was the only state in the nation to see an increase in loans in foreclosure over the previous quarter and now has the highest percentage of loans in foreclosure in the nation with eight percent of its loans in the foreclosure process. New Jersey also had the highest percentage of new foreclosures started in the first quarter of 2014, but also had a significant drop in its loans that were 90+ days delinquent, a sign that a large portion of loans previously held in the 90+ day delinquency category entered the foreclosure process during the quarter. emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 2.70% from 2.89% in Q4. This is a normal level.

Delinquent loans in the 60 day bucket decreased to 1.00% in Q1, from 1.06% in Q4. This is slightly above normal.

The 90 day bucket decreased to 2.41% from 2.45%. This is still way above normal (just under 1.0% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 2.65% from 2.86% and is now at the lowest level since Q1 2008.

This survey has shown steady improvement in delinquency and foreclosure rates, but it will take a few more years to work through the backlog - especially in judicial foreclosure states.

Note 1: Most of the remaining problems are with loans made in 2007 or earlier: "75 percent of seriously delinquent loans were originated in 2007 and earlier" and are in judicial foreclosure states.

Note 2: This survey includes all mortgage loans (including terrible lending via Wall Street). The total serious delinquency rate is 5.04% compared to 2.2% for Fannie and Freddie.