by Calculated Risk on 7/03/2014 01:03:00 PM

Thursday, July 03, 2014

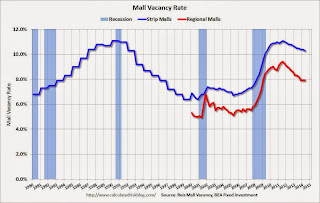

Reis: Strip Mall Vacancy Rate declined slightly in Q2, Regional Malls Unchanged

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q2 2014. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined slightly to 10.3% from 10.4% in Q1. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] The national vacancy rate for neighborhood and community shopping centers declined by 10 basis points to 10.3% during the second quarter. This was a marginal improvement over the first quarter when the national vacancy rate did not change. The national vacancy is now down 80 basis points from its historical peak during the third quarter of 2011. However, that translates into a less than 10 basis points per quarter compression in the vacancy rate.

...

[Regional] Vacancy during the second quarter was 7.9%, unchanged from the first quarter and down 40 basis points from the second quarter of 2013. Vacancy is also down 150 basis points from the historical‐high level of 9.4% reached during the third quarter of 2011. Asking rents grew by 0.4% in the second quarter and 1.8% during the last twelve months. This is the thirteenth consecutive quarter of rent increases at the national level for regional malls. While the mood surrounding malls at industry events continues to brighten, the data in recent quarters has become a bit less optimistic. The vacancy rate for malls has been unchanged over the last three quarters, although rent growth continues to accelerate. Even though the economy is recovering, the mall sector is grappling with the fallout surrounding store closures and retailers going out of business. This is putting upward pressure on vacancy at a time when improvement in the economy and labor market is gradually translating into slow increases in demand and net absorption.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.