by Calculated Risk on 7/26/2014 01:17:00 PM

Saturday, July 26, 2014

Schedule for Week of July 27th

This will be a busy week for economic data with several key reports including the July employment report on Friday and the advance Q2 GDP report on Wednesday.

Other key reports include the ISM manufacturing index on Friday, July vehicle sales, also on Friday, and the May Case-Shiller house price index on Tuesday.

There will a two-day FOMC meeting on Tuesday and Wednesday, and the Fed is expected to announce on Wednesday a decrease in asset purchases from $35 billion per month to $25 billion per month.

10:00 AM ET: Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for July. This is the last of the regional Fed manufacturing surveys for July.

During the day: the 2014 Social Security Trustees Reports

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May.

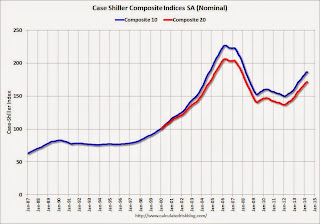

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the April 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 9.9% year-over-year increase in the Composite 20 index (NSA) for May. The Zillow forecast is for the Composite 20 to increase 9.6% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for July. The consensus is for the index to increase to 85.5 from 85.2.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 235,000 payroll jobs added in July, down from 280,000 in June.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (advance estimate); Includes historical revisions from the BEA. The consensus is that real GDP increased 2.9% annualized in Q2.

2:00 PM: FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 284 thousand.

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a increase to 63.0, up from 62.6 in June.

8:30 AM: Employment Report for July. The consensus is for an increase of 228,000 non-farm payroll jobs added in July, down from the 288,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to be unchanged at 6.1% in July.

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).June was the fifth month in a row with more than 200 thousand jobs added, and employment in June was up 2.495 million year-over-year.

The economy has added 9.7 million private sector jobs since employment bottomed in February 2010 (9.1 million total jobs added including all the public sector layoffs).

There are 895 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 415 thousand above the pre-recession peak.

8:30 AM: Personal Income and Outlays for June including revised estimates 2011 through May 2014. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 81.5, up from the preliminary reading of 81.3, and down from the June reading of 82.5.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in June at 55.3%. The employment index was at 52.8%, and the new orders index was at 58.9%.