by Calculated Risk on 8/04/2014 09:05:00 AM

Monday, August 04, 2014

Black Knight releases Mortgage Monitor for June

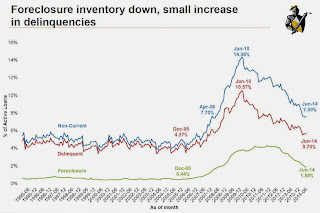

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for June today. According to BKFS, 5.70% of mortgages were delinquent in June, up from 5.62% in May. BKFS reports that 1.88% of mortgages were in the foreclosure process, down from 2.93% in June 2013.

This gives a total of 7.58% delinquent or in foreclosure. It breaks down as:

• 1,728,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,155,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 951,000 loans in foreclosure process.

For a total of 3,834,000 loans delinquent or in foreclosure in June. This is down from 4,785,000 in May 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

An analysis of the month’s mortgage performance data showed that the nation’s inventory of loans in foreclosure is disproportionately distributed in states with judicial foreclosure processes. According to Kostya Gradushy, Black Knight’s manager of Research and Analytics, while foreclosure inventories have been declining nationwide, judicial states’ foreclosure inventories are 3.5 times that of their non-judicial counterparts.There is much more in the mortgage monitor.

“Nationally, the foreclosure inventory rate has declined for 26 straight months, and is currently at its lowest point since April 2008, but this can obscure the stark difference that remains between judicial and non-judicial states,” said Gradushy. “Although judicial states account for about 42 percent of all active mortgages, some 70 percent of loans in foreclosure are in these states. Today, the share of loans in foreclosure in judicial states is 3.23 percent – a significant decline from its January 2012 high of 6.6 percent, but still more than four times higher than the pre-crisis ‘norm.’ Further, more than 60 percent of the foreclosure inventory in judicial states has been past due for two years or more. In fact, these loans have been delinquent an average of 1,084 days, as compared to just 775 days in non-judicial states. The states with the highest number of average days past due for loans in foreclosure are all judicial states: New York and Hawaii are each above 1,300 days, while New Jersey and Florida both top 1,200 days. emphasis added