by Calculated Risk on 8/26/2014 11:22:00 AM

Tuesday, August 26, 2014

House Prices: Better Seasonal Adjustment; Real Prices and Price-to-Rent Ratio Decline in June

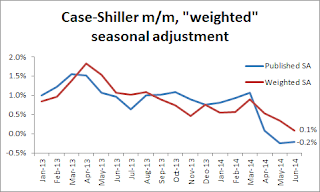

This morning, S&P reported that the Composite 20 index declined 0.2% in June seasonally adjusted. However, it appears the seasonal adjustment has been distorted by the high level of distressed sales in recent years. Trulia's Jed Kolko wrote last month: "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

The housing crisis substantially changed the seasonal pattern of housing activity: relative to conventional home sales, which peak in summer, distressed home sales are more evenly spread throughout the year and sell at a discount. As a result, in years when distressed sales constitute a larger share of overall sales, the seasonal swings in home prices get bigger while the seasonal swings in sales volumes get smaller.

Sharply changing seasonal patterns create problems for seasonal adjustment methods, which typically estimate seasonal adjustment factors by averaging several years’ worth of observed seasonal patterns. A sharp but ultimately temporary change in the seasonal pattern for housing activity affects seasonal adjustment factors more gradually and for more years than it should. Despite the recent normalizing of the housing market, seasonal adjustment factors are still based, in part, on patterns observed at the height of the foreclosure crisis, causing home price indices to be over-adjusted in some months and under-adjusted in others.

Kolko proposed a better seasonal adjustment:

Kolko proposed a better seasonal adjustment:This graph from Kolko shows the weighted seasonal adjustment (see Kolko's article for a description of his method). Kolko calculates that prices increased 0.1% on a weighted seasonal adjustment basis in June.

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory increases, and the slowdown is here! The Case-Shiller Composite 20 index was up 8.1% year-over-year in June; the smallest year-over-year increase since December 2012.

This is still a very strong year-over-year change, but on a seasonally adjusted monthly basis, the Case-Shiller Composite 20 index was down 0.2% in June (the second monthly decline in a row), and on a weighted seasonal adjusted basis (Kolko's method), the Composite 20 index was only up 0.1% in June. This suggests price increases have slowed sharply in recent months.

On a real basis (inflation adjusted), prices actually declined for the third consecutive month. The price-rent ratio also declined in June for the Case-Shiller Composite 20 index.

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

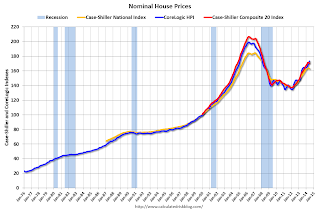

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, and the Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, and the Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to early 2005 levels (and also back up to July 2008), and the Case-Shiller Composite 20 Index (SA) is back to September 2004 levels, and the CoreLogic index (NSA) is back to January 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to June 2002 levels, the Composite 20 index is back to July 2002, and the CoreLogic index back to February 2003.

In real terms, house prices are back to early '00s levels.

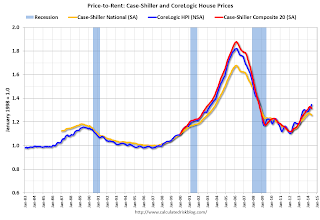

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to January 2003 levels, the Composite 20 index is back to October 2002 levels, and the CoreLogic index is back to June 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels. And real prices (and the price-to-rent ratio) have declined for three consecutive months using Case-Shiller National and Comp 20 indexes.