by Calculated Risk on 8/31/2014 09:26:00 PM

Sunday, August 31, 2014

Mortgage Rates: A Long Way to Fall for a Significant Increase in Refinance Activity

I've seen some recent discussion suggesting that mortgage refinance activity might pickup significantly if mortgage rates fall just a little more. I think this is incorrect.

First, from Freddie Mac last week: Mortgage Rates Remain Low Heading Into Holiday Weekend

Freddie Mac ... released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates largely unchanged amid mixed news on the housing front heading into the Labor Day weekend.

...

30-year fixed-rate mortgage (FRM) averaged 4.10 percent with an average 0.5 point for the week ending August 28, 2014, unchanged from last week. A year ago at this time, the 30-year FRM averaged 4.51 percent.

15-year FRM this week averaged 3.25 percent with an average 0.6 point, up from last week when it averaged 3.23 percent. A year ago at this time, the 15-year FRM averaged 3.54 percent.

Click on graph for larger image.

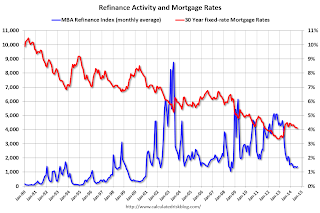

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply last year when mortgage rates increased. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Sure, borrowers who took out mortgages last year can probably refinance now - but that is a small number of total borrowers. For a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

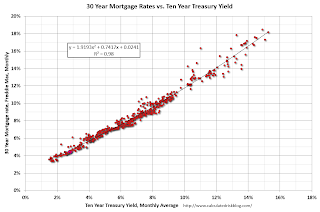

The second graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Currently the 10 year Treasury yield is at 2.34% and 30 year mortgage rates are at 4.10% (according to the Freddie Mac survey). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 3.5% when 10-year Treasury yields are around 1.4% (unlikely any time soon).

Currently the 10 year Treasury yield is at 2.34% and 30 year mortgage rates are at 4.10% (according to the Freddie Mac survey). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 3.5% when 10-year Treasury yields are around 1.4% (unlikely any time soon).To really have a refinance boom, 10-year Treasury yields would have to fall to 1% or so!

So I don't expect a significant increase in refinance activity any time soon.