by Calculated Risk on 8/30/2014 01:11:00 PM

Saturday, August 30, 2014

Schedule for Week of August 31st

This will be a busy week for economic data. The key report is the August employment report on Friday.

Other key reports include the ISM manufacturing index on Tuesday and August vehicle sales on Wednesday.

The ECB rate decision and press conference with ECB President Mario Draghi on Thursday will be closely watched.

All US markets will be closed in observance of the Labor Day holiday.

Early: Black Knight Mortgage Monitor report for July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for a decrease to 56.8 from 57.1 in July.

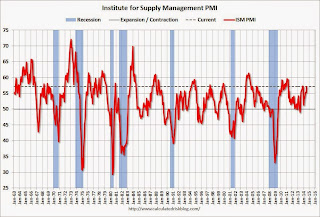

10:00 AM: ISM Manufacturing Index for August. The consensus is for a decrease to 56.8 from 57.1 in July.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in July at 57.1%. The employment index was at 58.2%, and the new orders index was at 63.4%.

10:00 AM: Construction Spending for July. The consensus is for a 0.8% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 16.5 million SAAR in August from 16.4 million in July (Seasonally Adjusted Annual Rate).

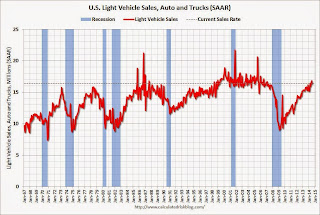

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 16.5 million SAAR in August from 16.4 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is for a 10.5% increase in July orders.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

1:45 PM CET (7:45 AM ET): Press conference following the Governing Council meeting of the ECB in Frankfurt with Mario Draghi. Here is the ECB website and press conference page.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 213,000 payroll jobs added in August, down from 218,000 in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 298 thousand.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. Imports decreased and exports increased in June.

The consensus is for the U.S. trade deficit to be at $42.7 billion in July from $41.5 billion in June.

10:00 AM: ISM non-Manufacturing Index for August. The consensus is for a reading of 57.1, down from 58.7 in July. Note: Above 50 indicates expansion.

8:30 AM: Employment Report for August. The consensus is for an increase of 210,000 non-farm payroll jobs added in August, up slightly from the 209,000 non-farm payroll jobs added in July.

The consensus is for the unemployment rate to decrease to 6.1% in August.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was 2.570 million jobs, and it generally appears the pace of hiring is increasing.

Right now it looks possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.