by Calculated Risk on 9/24/2014 11:25:00 AM

Wednesday, September 24, 2014

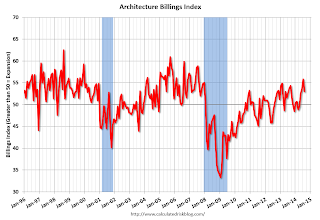

AIA: "Architecture Billings Index Exhibits Continued Strength" in August

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Exhibits Continued Strength

On the heels of recording its strongest pace of growth since 2007, there continues to be an increasing level of demand for design services signaled in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 53.0, down from a mark of 55.8 in July. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.6, following a very strong mark of 66.0 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in August was 56.9.

“One of the key triggers for accelerating growth at architecture firms is that long-stalled construction projects are starting to come back to life in many areas across the country,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Long awaited access to credit from lending institutions and an increasing comfort level in the overall economy has helped revitalize the commercial real estate sector in recent months. Additionally, though, a crucial component to a broader industry-wide recovery is the emerging demand for new projects such as education facilities, government buildings and, in some cases, hospitals.”

• Regional averages: Northeast (58.1) , South (55.1), West (52.5), Midwest (51.0) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.0 in August, down from 55.8 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the readings over the last year suggest an increase in CRE investment this year and in 2015.