by Calculated Risk on 10/28/2014 11:59:00 AM

Tuesday, October 28, 2014

House Prices: Real Prices and Price-to-Rent Ratio in August

I started 2014 expecting a slowdown in year-over-year (YoY) house prices as "For Sale" inventory increases - and the price slowdown is very clear. The Case-Shiller Composite 20 index was up 5.6% YoY in August; the smallest YoY increase since October 2012 (the National index was up 5.1%, also the slowest YoY increase since October 2012.

This slowdown was expected by several key analysts, and I think it is good news. As Zillow chief economist Stan Humphries said today:

“After several months in a row of slowing home value growth, it’s fair to say now the market has officially turned a corner and entered a new phase of the recovery. We’re transitioning away from a period of hot and bothered market activity, characterized by low inventory and rapid price growth, onto a more slow and steady trajectory, which is great news. In housing, boring is better."Boring - in the housing market - would be good!

emphasis added

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

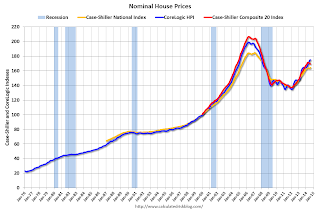

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to February 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to September 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to September 2002 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to March 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2003 levels, the Composite 20 index is back to September 2002 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels - and maybe moving a little sideways now.