by Calculated Risk on 10/04/2014 01:11:00 PM

Saturday, October 04, 2014

Schedule for Week of October 5th

This will be a very light week for economic data although there will be plenty of Fed speeches (not listed).

Perhaps the most interesting releases this week will be the Fed's new Labor Market Conditions Index on Monday, and the Treasury Budget for September (end of fiscal year) on Friday.

Early: Black Knight Mortgage Monitor report for August.

At 10:00 AM ET: The Fed will release the new monthly Labor Market Conditions Index (LMCI).

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

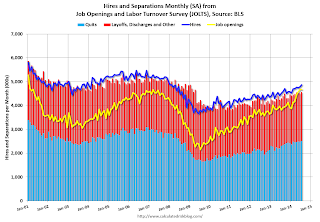

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased slightly in July to 4.673 million from 4.675 million in June.

The number of job openings (yellow) were up 22% year-over-year. Quits were up 9% year-over-year.

3:00 PM: Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $20.5 billion.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for the September 16-17, 2014.

Early: Trulia Price Rent Monitors for September. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 287 thousand.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.3% increase in inventories.

2:00 PM ET: The Monthly Treasury Budget Statement for September.

5:00 PM ET, Speech by Fed Vice Chairman Stanley Fischer, The Federal Reserve and the Global Economy, at the 2014 International Monetary Fund Annual Meetings: Per Jacobsson Lecture, Washington, D.C. The speech can be viewed live at the IMF website.