by Calculated Risk on 12/02/2014 10:03:00 AM

Tuesday, December 02, 2014

Construction Spending increased 1.1% in October

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2014 was estimated at a seasonally adjusted annual rate of $971.0 billion, 1.1 percent above the revised September estimate of $960.3 billion.Both private and public spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $692.4 billion, 0.6 percent above the revised September estimate of $688.0 billion. Residential construction was at a seasonally adjusted annual rate of $353.8 billion in October, 1.3 percent above the revised September estimate of $349.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $338.6 billion in October, 0.1 percent below the revised September estimate of $338.9 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In October, the estimated seasonally adjusted annual rate of public construction spending was $278.6 billion, 2.3 percent above the revised September estimate of $272.3 billion.

emphasis added

As an example, construction spending for lodging is up 16% year-over-year, whereas spending for power (includes oil and gas) construction is declining since peaking in May.

Click on graph for larger image.

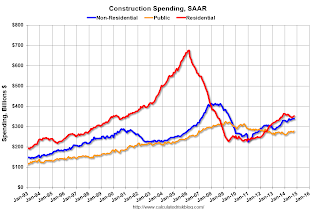

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 48% below the peak in early 2006 - but up 55% from the post-bubble low.

Non-residential spending is 18% below the peak in January 2008, and up about 50% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and about 7% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 2%. Non-residential spending is up 6% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was a strong report - well above the consensus forecast of a 0.5% increase - and there were also upward revisions to spending in August and September.