by Calculated Risk on 4/03/2015 10:45:00 AM

Friday, April 03, 2015

Employment Report Comments and Graphs

Earlier: March Employment Report: 126,000 Jobs, 5.5% Unemployment Rate

This was a disappointing employment report with 126,000 jobs added, and downward revisions to the January and February reports (combined were 69,000 less than previously reported).

However, maybe there was a hint of good news on wage growth, from the BLS: "In March, average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $24.86. Over the year, average hourly earnings have risen by 2.1 percent." However weekly hours declined in March.

A few more numbers: Total employment increased 126,000 from February to March and is now 2.8 million above the previous peak. Total employment is up 11.5 million from the employment recession low.

Private payroll employment increased 129,000 from February to March, and private employment is now 3.3 million above the previous peak. Private employment is up 12.1 million from the recession low.

In March, the year-over-year change was 3.1 million jobs. This was the fourth month in a row with the year-over-year gain above 3.1 million.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 80.9%, and the 25 to 54 employment population ratio decreased to 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

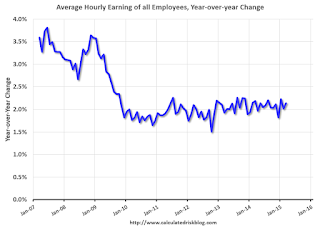

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased slightly to 2.1%, and wages were revised up from January and February. Wages will probably pick up a little this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in March at 6.7 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased in March to 6.705 million from 6.635 million in February. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 10.9% in February from 11.0% in February. This is the lowest level for U-6 since August 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.563 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.709 million in January. This is trending down, but is still very high.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In March 2015, state and local governments lost 1,000 jobs. State and local government employment is now up 128,000 from the bottom, but still 630,000 below the peak.

State and local employment is now generally increasing. And Federal government layoffs have slowed (Federal payrolls lost 2,000 jobs in March).

This was a disappointing report for March, but the year-over-year employment gains are still solid.