by Calculated Risk on 4/30/2015 05:25:00 PM

Thursday, April 30, 2015

Q1 2015 GDP Details on Residential and Commercial Real Estate

The BEA released the underlying details for the Q1 advance GDP report today.

Yesterday, the BEA reported that investment in non-residential structures decreased at a 23.1% annual rate in Q1.

All of the decline could be attributed to less petroleum exploration and less investment in electrical. Both declined at a 50% annual rate in Q1.

There was some weakness in lodging investment, but that might be weather related. Excluding petroleum and electrical, non-residential investment in structures was unchanged in Q1.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased slightly in Q1, is down about 43% from the recent peak (as a percent of GDP) and increasing from a very low level - and is still below the lows for previous recessions (as percent of GDP). With the high office vacancy rate, office investment will only increase slowly.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 59% from the peak. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment declined in Q1, but with the hotel occupancy rate near record levels, it is likely that hotel investment will increase in the near future. Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 65%.

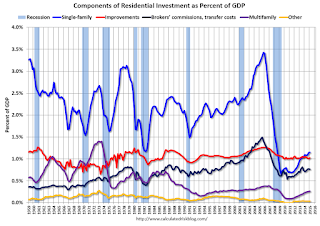

Investment in single family structures is now back to being the top category for residential investment. Home improvement was the top category for twenty consecutive quarters following the housing bust ... but now investment in single family structures has been back on top for the last 6 quarters and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $204 billion (SAAR) (over 1.1% of GDP).

Investment in home improvement was at a $182 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just over 1.0% of GDP).

These graphs show investment is generally increasing, but from a very low level.