by Calculated Risk on 4/02/2015 11:47:00 AM

Thursday, April 02, 2015

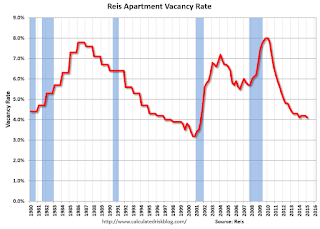

Reis: Apartment Vacancy Rate decreased in Q1 to 4.1%

Reis reported that the apartment vacancy rate declined in Q1 2015 to 4.1%, down from 4.2% in Q4 2014, and the same as in Q1 2014. The vacancy rate peaked at 8.0% at the end of 2009.

A few comments from Reis Senior Economist and Director of Research Ryan Severino:

The apartment market pulled a bit of a surprise during the first quarter of 2015. After appearing to reach an inflection point last year, beyond which the national vacancy rate would continue rising, vacancy actually declined by 10 basis points to 4.1%. This decrease in vacancy was primarily due to relatively weak new completions during the first quarter. Although weak first quarters for completions has become a bit of a norm in recent years as seasonality has returned to the market, it is a bit surprising this year because of the large pipeline of projects slated to come online in 2015, including many new units that were supposed to be completed last year but were delayed until this year. On the other side of the ledger, demand remains relatively robust as we projected it would.

...

The 4.1% vacancy rate matches the cyclical low that was attained during the first half of 2014. The decline was predominantly due to relatively weak supply growth during the quarter – although demand exceeded supply, net absorption was also relatively weak during the quarter as is usually wont to happen during the first quarter of calendar years. Despite this quarter’s decline, over the last twelve months the national vacancy rate was unchanged, indicating that the national vacancy rate has likely bottomed and should rise during the balance of 2015. The massive amounts of new supply that are coming online over the next few years should exceed demand which will gradually push the vacancy rate upward. However, due to the large number of individuals between the ages of 20 and 29 in the US, demand will remain relatively stout which will cause vacancy to rise at a somewhat measured pace.

Asking and effective rents both grew by 0.6% during the first quarter. This also follows the slowing trend of the last few quarters, but seasonality was likely a factor in this lack of acceleration versus the fourth quarter of 2014. The deceleration in rent growth in recent quarters has caused even the year-over-year growth rate to decline. Over the last four quarters, rent growth for asking and effective rents was 3.4% and 3.5%, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

Apartment vacancy data courtesy of Reis.