by Calculated Risk on 4/03/2015 01:31:00 PM

Friday, April 03, 2015

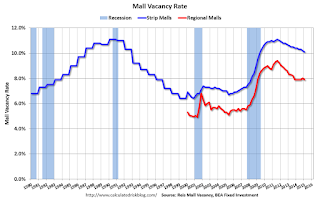

Reis: Mall Vacancy Rate declined in Q1

Reis reported that the vacancy rate for regional malls was decreased to 7.9% in Q1 2015 from 8.0% in Q4. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate decreased to 10.1% in Q1, from 10.2% in Q4. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

[Strip Malls] Following the trend of recent quarters, neighborhood and community center vacancy declined by just 10 basis points during the quarter to 10.1%. Although neither net absorption nor construction were particularly robust, demand exceeded supply by a wide enough margin to cause vacancy rates to continue falling. Although rent growth remains weak, that fact that it even continues to grow in the face of such an elevated vacancy rate is a mildly heartening sign for the sector.

[Regional] The vacancy rate for malls also declined by 10 basis points while asking rents grew by 0.5%, the sixteenth consecutive quarter of growth. Taken together, the data for both neighborhood and community centers and malls indicates that the recovery, while not yet accelerating, is becoming more consistent. Quarterly rent growth is now the norm and continues to drift higher while vacancy compression, though slowing for regional malls, is also beginning to occur on a quarterly basis.

...

The quarterly improvement in market fundamentals should persist as we move forward in 2015. ... Construction remained at low levels during the first quarter and is not set to change anytime soon. The combination of little supply growth and increasing demand bodes well for most retail formats in the US.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.