U.S. energy companies are planning more layoffs, asset sales and financial maneuvers to deal with a recent, sudden drop in U.S. crude-oil prices to under $50 a barrel, the lowest level in four months.

...

Nearly 50,000 energy jobs have been lost in the past three months on top of 100,000 employees laid off since oil prices started to tumble last fall, according to Graves & Co., a Houston energy consultancy.

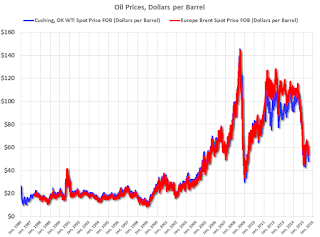

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices Friday added). According to Bloomberg, WTI was at $48.14 per barrel on Friday, and Brent at $54.62.

Prices are down about 50% year-over-year.

The second graph shows the prices over the last few years.

Some producers stopped cutting when prices started to rebound, but now prices are declining again - and there will probably be more layoffs in the oil sector.

Some producers stopped cutting when prices started to rebound, but now prices are declining again - and there will probably be more layoffs in the oil sector. Note: Several oil producing states are already in recession such as North Dakota, Oklahoma and Alaska, but overall lower oil prices will be a positive for the U.S. economy.