by Calculated Risk on 8/24/2015 04:24:00 PM

Monday, August 24, 2015

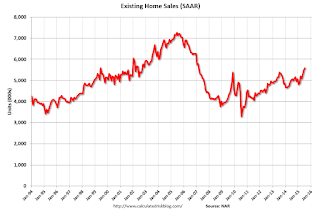

Catching Up: Existing Home Sales in July: 5.59 million SAAR, Highest Pace in Eight Years

While I was on vacation, there were several key economic releases. I'm catching up ...

The NAR reported last week: Existing-Home Sales Maintain Solid Growth in July

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 2.0 percent to a seasonally adjusted annual rate of 5.59 million in July from a downwardly revised 5.48 million in June. Sales in July remained at the highest pace since February 2007 (5.79 million), have now increased year-over-year for ten consecutive months and are 10.3 percent above a year ago (5.07 million). ...

Total housing inventory at the end of July declined 0.4 percent to 2.24 million existing homes available for sale, and is now 4.7 percent lower than a year ago (2.35 million). Unsold inventory is at a 4.8-month supply at the current sales pace, down from 4.9 months in June.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.59 million SAAR) were 2.0% higher than last month, and were 10.3% above the July 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.24 million in July from 2.25 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.24 million in July from 2.25 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.7% year-over-year in July compared to July 2014.

Inventory decreased 4.7% year-over-year in July compared to July 2014. Months of supply was at 4.8 months in June.

This was above expectations of sales of 5.40 million.

As always, new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. Also I wouldn't be surprised if the seasonally adjusted pace for existing home sales slows over the next several months due to limited inventory.

Inventory is still very low (down 4.7% year-over-year in July). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch.

Also, the NAR reported total sales were up 10.3% from July 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Representing the lowest share since NAR began tracking in October 2008, distressed sales — foreclosures and short sales — declined to 7 percent in July from 8 percent in June; they were 9 percent a year ago. Five percent of July sales were foreclosures and 2 percent were short sales.Last year in July the NAR reported that 9% of sales were distressed sales.

A rough estimate: Sales in July 2014 were reported at 5.07 million SAAR with 9% distressed. That gives 456 thousand distressed (annual rate), and 4.64 million equity / non-distressed. In July 2015, sales were 5.59 million SAAR, with 7% distressed. That gives 391 thousand distressed - a decline of about 14% from July 2014 - and 5.20 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 13%.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in July (red column) were the highest for July since 2006 (NSA).

Sales NSA in July (red column) were the highest for July since 2006 (NSA).