by Calculated Risk on 9/23/2015 09:04:00 AM

Wednesday, September 23, 2015

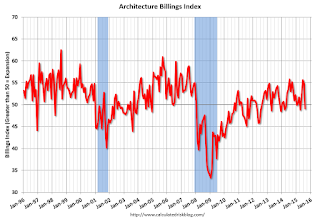

AIA: Architecture Billings Index indicated slight contraction in August

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Backslides Slightly

The Architecture Billings Index (ABI) slipped in August after showing mostly healthy business conditions so far this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 49.1, down from a mark of 54.7 in July. This score reflects a slight decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.8, down from a reading of 63.7 the previous month.

“Over the past several years, a period of sustained growth in billings has been followed by a temporary step backwards,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The fact that project inquiries and new design contracts continue to grow at a healthy pace suggests that this should not be a cause for concern throughout the design and construction industry.”.

...

• Regional averages: Midwest (56.1), South (53.8), West (50.2) Northeast (46.8)

• Sector index breakdown: institutional (53.7), mixed practice (52.8), commercial / industrial (49.7) multi-family residential (49.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.1 in August, down from 54.7 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for the seventh consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.