by Calculated Risk on 9/08/2015 10:42:00 AM

Tuesday, September 08, 2015

Black Knight July Mortgage Monitor

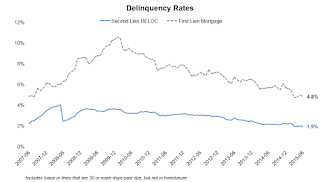

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for July today. According to BKFS, 4.71% of mortgages were delinquent in July, down from 4.82% in June. BKFS reported that 1.40% of mortgages were in the foreclosure process, down from 1.85% in July 2014.

This gives a total of 6.11% delinquent or in foreclosure. It breaks down as:

• 1,503,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 886,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 711,000 loans in foreclosure process.

For a total of 3,100,000 loans delinquent or in foreclosure in July. This is down from 3,785,000 in July 2014.

Press Release: Black Knight’s July Mortgage Monitor: Total Equity in U.S. Mortgage Market at $7.6 Trillion, Up $825 Billion Year-to-Date; $4.5 Trillion in Equity “Tappable” by Borrowers

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of July 2015. Looking at the nation’s population of mortgage holders and comparing first and second lien debt against May property values, Black Knight has determined that total home equity in the U.S. has increased by nearly $1 trillion in the past year to the highest level since 2007. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, this growth in available equity has direct implications for borrowers’ ability to access the equity in their homes.

“We’ve seen total home equity in the mortgage market expand by $825 billion in just the first five months of this year,” said Graboske. “At $7.6 trillion, total net equity is nearly 2.5 times more than it was at the end of 2011, and is at the highest level it’s been since the start of the housing crisis. To put this growth in perspective, consider that the average American homeowner with a mortgage has about $19,000 more equity in his or her home today than a year ago."

Click on graph for larger image.

Click on graph for larger image.From Black Knight:

Second lien HELOC delinquency rates are currently at 1.9 percent, the lowest level seen since April 2007There is much more in the mortgage monitor.

Delinquency rates on second lien HELOCs have declined by over 11 percent so far in 2015, slightly behind the 16 percent reduction on first lien mortgage delinquencies