by Calculated Risk on 10/09/2015 07:10:00 PM

Friday, October 09, 2015

Sacramento Housing in September: Sales up 13%, Inventory down 19% YoY

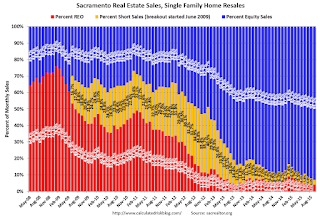

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September, total sales were up 13.1% from September 2014, and conventional equity sales were up 18.5% compared to the same month last year.

In September, 6.9% of all resales were distressed sales. This was down from 7.8% last month, and down from 11.1% in September 2014. This is the lowest percentage of distressed sales since they started breaking out distressed sales).

The percentage of REOs was at 4.1% in September, and the percentage of short sales was 2.7.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales. Distressed sales are so small, the font doesn't fit.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 18.5% year-over-year (YoY) in September. This was the fifth consecutive monthly YoY decrease in inventory in Sacramento (a big recent change).

Cash buyers accounted for 15.6% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying.