HUD: FHA'S 2015 Annual Report Shows Capital Reserves Now Exceed 2%, First Time Since 2008

From HUD:

FHA'S 2015 ANNUAL REPORT SHOWS CAPITAL RESERVES NOW EXCEED 2%

The U.S. Department of Housing and Urban Development (HUD) today released its annual report to Congress on the financial condition of the Federal Housing Administration’s Mutual Mortgage Insurance (MMI) Fund. The independent actuarial analysis shows the MMI Fund’s capital ratio stands at 2.07 percent—the first time since 2008 that FHA’s reserve ratio exceeded the congressionally required 2 percent threshold. The economic value of the MMI Fund gained $19 billion in Fiscal Year 2015, driven by strong actions to reduce risk, cut losses and improve recoveries.

This is the third consecutive year of economic growth for the MMI Fund, allowing FHA to expand credit access to qualified borrowers even as the broader housing market continues to recover. FHA’s annual report also notes a significant increase in loan volume during FY 2015, due largely to a reduction in annual mortgage insurance premium prices announced in January. Read a comprehensive summary of the report released today.

“FHA is on solid financial footing and positioned to continue playing its vital role in assisting future generations of homeowners,” said HUD Secretary Julián Castro. “We’ve taken a number of steps to strengthen the Fund and increase credit access to responsible borrowers. Today’s report demonstrates that we struck the right balance in responsibly growing the Fund, reducing premiums, and doing what FHA was born to do – allowing hardworking Americans to become homeowners and spurring growth in the housing market as well as the broader economy.”

From the report:

Click on graph for larger image.

Click on graph for larger image.

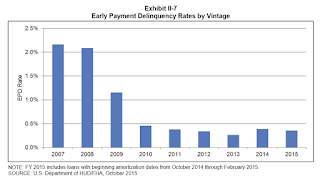

The quality of new business is reflected by early payment delinquencies (EPD) rates. The EPD rate is the rate at which loans experience 90-day delinquencies within the first six months of origination, another metric that suggests the sustainability of the recovery in the Forward portfolio. EPD rates provide the first indication of potential credit performance of newly insured loans and are a leading indicator of the long-term claim risk of a particular book of business.

The EPD performance of FHA’s portfolio in FY 2015 continued trends seen in recent years, as newer books of business vastly outperform those insured in prior years. EPD rates for the FY 2010 through February 2015 vintages are less than 20 percent of the EPD rates for the FY 2007 and 2008 vintages (Exhibit II-7).

The number of seriously delinquent FHA loans (loans that are 90 or more days past due) continued to decline in FY 2015. Exhibit II-8 shows the serious delinquency rate has fallen by 35 percent over the last four years, a nearly $35 billion improvement in the size of the seriously delinquent portfolio over that time.

Click on graph for larger image.

Click on graph for larger image.