by Calculated Risk on 12/23/2015 11:50:00 AM

Wednesday, December 23, 2015

Comments on November New Home Sales

The new home sales report for October was somewhat below expectations, and sales for August, September and October were revised down. Sales were up 9.1% year-over-year in November (SA).

Earlier: New Home Sales increased to 490,000 Annual Rate in November.

Even though the November report was somewhat disappointing, sales are still up solidly year-to-date. The Census Bureau reported that new home sales this year, through November, were 461,000, not seasonally adjusted (NSA). That is up 14.5% from 402,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for 2015 through November.

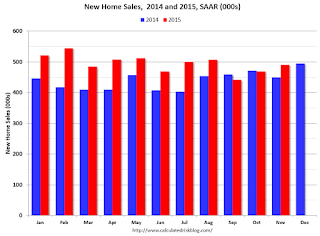

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gains were stronger earlier this year, but the overall year-over-year gain should be solid in 2015. The comparisons in early 2016 will be more difficult.

Overall this was a solid year for new home sales.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.