by Calculated Risk on 12/15/2015 08:58:00 AM

Tuesday, December 15, 2015

CoreLogic: "Number of Mortgaged Properties with Negative Equity Down 20.7% Year Over Year"

From CoreLogic: CoreLogic Reports 256,000 US Properties Regained Equity in the Third Quarter of 2015

CoreLogic ... today released a new analysis showing 256,000 properties regained equity in the third quarter of 2015, bringing the total number of mortgaged residential properties with equity at the end of Q3 2015 to approximately 46.3 million, or 92.0 percent of all homes with an outstanding mortgage. Nationwide, borrower equity increased year over year by $741 billion in Q3 2015.On states:

The total number of mortgaged residential properties with negative equity stood at 4.1 million, or 8.1 percent, in Q3 2015. That was down 4.7 percent quarter over quarter from 4.3 million homes, or 8.7 percent, compared with Q2 2015 and down 20.7 percent year over year from 5.2 million homes, or 10.4 percent, compared with Q3 2014. ...

For the homes in negative equity status, the national aggregate value of negative equity was $301 billion at the end of Q3 2015, declining approximately $8.1 billion from $309.1 billion in Q2 2015, a decrease of 2.6 percent. On a year-over-year basis, the value of negative equity declined overall from $341 billion in Q3 2014, representing a decrease of 11.8 percent in 12 months.

Of the more than 50 million residential properties with a mortgage, approximately 8.9 million, or 17.6 percent, have less than 20 percent equity (referred to as “under-equitied”) and 1.1 million, or 2.2 percent, have less than 5 percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” may have a difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near-negative equity are considered at risk of moving into negative equity if home prices fall.

“Home price growth continued to lift borrower equity positions and increase the number of borrowers with sufficient equity to participate in the mortgage market," said Frank Nothaft, chief economist for CoreLogic. "In Q3 2015 there were 37.5 million borrowers with at least 20 percent equity, up 7 percent from 35 million in Q3 2014. In the last three years, borrowers with at least 20 percent equity have increased by 11 million, a substantial uptick that is driving rapid growth in home equity originations.”

emphasis added

"Nevada had the highest percentage of mortgaged residential properties in negative equity at 19.0 percent, followed by Florida (17.8 percent), Arizona (14.6 percent), Rhode Island (12.3 percent) and Maryland (12.1 percent). Combined, these five states account for 29.3 percent of negative equity in the U.S. "Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago.

Click on graph for larger image.

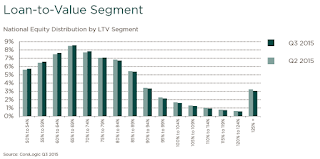

Click on graph for larger image.This graph shows the distribution of home equity in Q3 2015 compared to Q2 2015. In Q3, 3.0% of residential properties have 25% or more negative equity, down from 3.2% in Q2 2015.

For reference, three years ago, in Q3 2012, 9.6% of residential properties had 25% or more negative equity.

A year ago, in Q3 2014, there were 5.2 million properties with negative equity - now there are 4.1 million. A significant change.