by Calculated Risk on 4/02/2016 08:09:00 AM

Saturday, April 02, 2016

Schedule for Week of April 3, 2016

This will be a light week for economic data.

The key economic report is the trade balance on Tuesday.

Also the quarterly Reis surveys for office, apartment and malls will be released this week.

Early: Reis Q1 2016 Office Survey of rents and vacancy rates.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

Early: Reis Q1 2016 Apartment Survey of rents and vacancy rates.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $46.2 billion in February from $45.7 billion in January.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

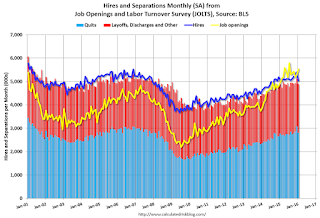

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 5.541 million from 5.281 million in December.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 1% year-over-year.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for index to increase to 54.0 from 53.4 in February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q1 2016 Mall Survey of rents and vacancy rates.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of March 15-16, 2016

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 272 thousand initial claims, down from 276 thousand the previous week.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $14 billion increase in credit.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.2% decrease in inventories.