From Fannie Mae: Fannie Mae Reports Net Income of $1.1 Billion and Comprehensive Income of $936 Million for First Quarter 2016

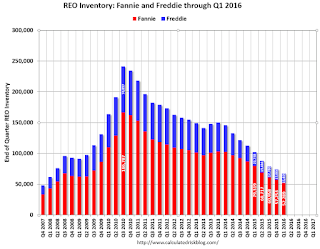

Fannie Mae reported net income of $1.1 billion and comprehensive income of $936 million for the first quarter of 2016. The company reported a positive net worth of $2.1 billion as of March 31, 2016, which the company expects will result in its paying Treasury a $919 million dividend in June 2016.Fannie Mae reported the number of REO declined to 52,289 at the end of Q1 2016 compared to 79,319 at the end of Q1 2015.

Freddie Mac reported the number of REO (Real Estate Owned) declined to 15,409 at the end of Q1 2106 compared to 22,738 at the end of Q1 2015.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q1 for both Fannie and Freddie, and combined inventory is down 34% year-over-year. For Freddie, this is the lowest level of REO since Q4 2007. For Fannie, this is the lowest level since Q1 2008.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.