by Calculated Risk on 6/30/2016 12:21:00 PM

Thursday, June 30, 2016

CoStar: Commercial Real Estate prices increased in May

Here is a price index for commercial real estate that I follow.

From CoStar: Composite Price Indices Resume Solid Growth Boosted By Strong Net Absorption

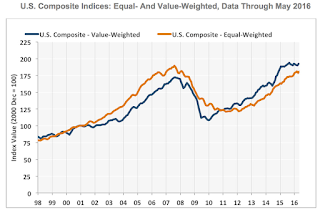

PRICE INDICES RESUMED SOLID GROWTH IN MAY. Both of CCRSI’s two major composite price indices advanced by more than 1% in the month of May 2016, erasing earlier-year declines. After the two major indices backtracked in the first quarter of 2016 amid global economic uncertainty and a seasonal slowdown in investment activity, price growth within the commercial real estate sector during May 2016 returned to the average monthly pace set in the previous several years. The equal-weighted U.S. Composite Index rose 1.1% and the value-weighted U.S. Composite Index advanced 1.2% in May 2016, placing the value-weighted index at its highest level this cycle.

HEALTHY CRE SPACE ABSORPTION CONTRIBUTED TO STRONG PRICE GAINS. Demonstrating the overall demand for CRE space, net absorption across the three major property types—office, retail and industrial—is projected to total 688.5 million square feet for the 12-month period ending in June 2016, a 9.5% increase from the same period ending in June 2015. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index increased 1.2% in May and is up 2.2% year-over-year.

The equal-weighted index increased 1.1% in May and is up 6.7% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.