by Calculated Risk on 6/04/2016 08:09:00 AM

Saturday, June 04, 2016

Schedule for Week of June 5, 2016

This will be a light week for economic data.

Fed Chair Janet Yellen will speak on Monday.

The Census Bureau will release the Q1 Quarterly Services Report on Wednesday, and the Fed will release the Q1 Flow of Funds report on Thursday.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

12:30 PM ET, Speech by Fed Chair Janet Yellen, Economic Outlook and Monetary Policy, To the World Affairs Council of Philadelphia, Philadelphia, Pa.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $18.0 billion increase in credit.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

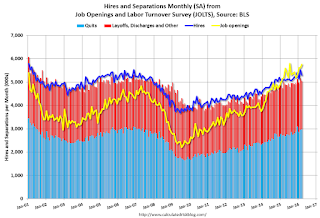

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in March to 5.757 million from 5.608 million in February.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 9% year-over-year.

10:00 AM: The Q1 Quarterly Services Report from the Census Bureau.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.1% increase in inventories.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

2:00 PM: The Monthly Treasury Budget Statement for May.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 94.5, down from 94.7 in May.