by Calculated Risk on 7/21/2016 05:44:00 PM

Thursday, July 21, 2016

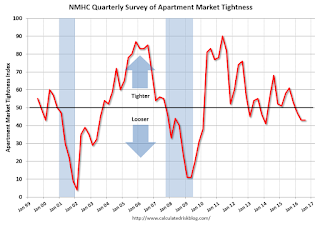

NMHC: Apartment Market Tightness Index remained negative in July Survey

From the National Multifamily Housing Council (NMHC): Apartment Markets Remain Mixed According to the Latest NMHC Quarterly Survey

Apartment markets continued to show mixed conditions in the July 2016 National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. For the third quarter in a row, the Market Tightness (43) and Equity Financing (44) Indexes remained below the breakeven level of 50. Conversely, the Debt Financing Index came in at 62 and the Sales Volume Index landed right at 50.

“Apartment markets remain strong, but the surge of new apartment construction is starting to shift the supply-demand balance, particularly in the market for upscale apartments,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Given that most new supply is class A, we’re not seeing the same shift in class B and C apartments. In addition, some weakness in the Market Tightness Index may be just seasonality.”

For the third quarter in a row, the Market Tightness Index, which was unchanged at 43, showed supply a bit stronger than demand. Almost one-third of respondents (31 percent) reported looser conditions than three months ago. At the other end, 18 percent noted tighter conditions, while over half (51 percent) reported no change.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the third consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to slow (the vacancy rate is generally rising too).