by Calculated Risk on 9/06/2016 09:12:00 AM

Tuesday, September 06, 2016

CoreLogic: House Prices up 6.0% Year-over-year in July

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6 Percent Year Over Year in July 2016

Home prices nationwide, including distressed sales, increased year over year by 6 percent in July 2016 compared with July 2015 and increased month over month by 1.1 percent in July 2016 compared with June 2016, according to the CoreLogic HPI.

...

“If mortgage rates continue to remain relatively low and job growth continues, as most forecasters expect, then home purchases are likely to rise in the coming year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The increased sales will support further price appreciation, and according to the CoreLogic Home Price Index, home prices are projected to rise about 5 percent over the next year.”

“The strongest home price gains continue to be in the western region,” said Anand Nallathambi, president and CEO of CoreLogic. “As evidence, the Denver, Portland and Seattle metropolitan areas all recorded double-digit appreciation over the past year.”

emphasis added

Click on graph for larger image.

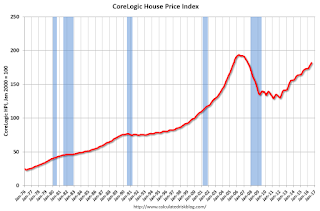

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in July (NSA), and is up 6.0% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 6.1% below the bubble peak in nominal terms (not inflation adjusted).

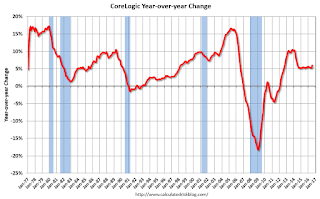

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty four consecutive months.