by Calculated Risk on 9/10/2016 08:09:00 AM

Saturday, September 10, 2016

Schedule for Week of Sept 11, 2016

The key economic reports this week are August Retail Sales and the August Consumer Price Index (CPI).

For manufacturing, August industrial production, and the September New York Fed manufacturing surveys, will be released this week.

1:15 PM: Speech by Fed Governor Lael Brainard, The Economic Outlook and Monetary Policy Implications, At the Chicago Council on Global Affairs: Global Economic Series, Chicago, Illinois. Watch live here.

9:00 AM ET: NFIB Small Business Optimism Index for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

8:30 AM ET: Retail sales for August will be released. The consensus is for no change in retail sales in August.

8:30 AM ET: Retail sales for August will be released. The consensus is for no change in retail sales in August.This graph shows retail sales since 1992 through July 2016.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of -1.0, up from -4.2.

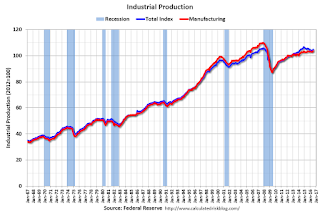

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.7%.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.1% increase in inventories.

8:30 AM: The Consumer Price Index for August from the BLS. The consensus is for 0.1% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 90.8, up from 89.8 in July.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.