by Calculated Risk on 11/10/2016 11:42:00 AM

Thursday, November 10, 2016

MBA: Mortgage Delinquencies and Foreclosures Decrease in Q3

From the MBA: Delinquencies and Foreclosures Decrease in Latest Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased 14 basis points to a seasonally adjusted rate of 4.52 percent of all loans outstanding at the end of the third quarter of 2016. This was the lowest level since the second quarter of 2006 when the delinquency rate was 4.39 percent. The delinquency rate was 47 basis points lower than one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.30 percent, a decrease of two basis points from the previous quarter, and down eight basis points from one year ago. This foreclosure starts rate was at its lowest level since the second quarter of 2000.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.55 percent, down nine basis points from the previous quarter and 33 basis points lower than one year ago. The foreclosure inventory rate was at its lowest level since the second quarter of 2007.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.96 percent, a decrease of 15 basis points from previous quarter, and a decrease of 61 basis points from last year. The serious delinquency rate was at its lowest level since the third quarter of 2007.

emphasis added

Click on graph for larger image.

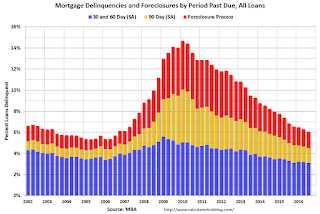

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Note that the total percent delinquencies and foreclosures is below the 2002 level.

The percent of loans 30 and 60 days delinquent ticked down in Q3, and is below the normal historical level.

The 90 day bucket declined further in Q3, but remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is still above the historical average.

The 90 day bucket and foreclosure inventory are still elevated, but should be close to normal in 2017. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.