by Calculated Risk on 12/02/2016 10:01:00 AM

Friday, December 02, 2016

Comments: Solid November Employment Report, Sharp Drop in Unemployment Rate

The headline jobs number was solid. Job growth was somewhat above the consensus forecast (178,000 vs forecast of 170,000), amd the unemployment rate declined sharply to 4.6%.

Earlier: November Employment Report: 178,000 Jobs, 4.6% Unemployment Rate

Job growth has averaged 180,000 per month this year.

In November, the year-over-year change was 2.25 million jobs.

A negative was the decline in hourly earnings, but this was probably just seasonal noise - and payback for the strong gain in October. This is a noisy series, and the trend is clearly up.

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in November.

Note: CPI has been running around 2%, so there has been real wage growth.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers in October and November at a lower pace than the last few years.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 522 thousand workers (NSA) net in October and November, this is down from just over 600 thousand for the same period over the last several years. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are a little cautious about the holiday season. Note: There is a decent correlation between October seasonal retail hiring and holiday retail sales. Maybe retailers are having trouble finding seasonal hires.

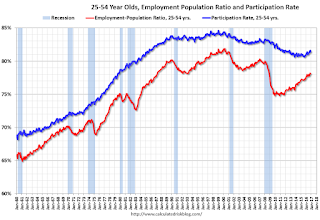

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in October to 81.4%, and the 25 to 54 employment population ratio decreased to 78.1%.

The participation rate has been trending down for this group since the late '90s, however, with more younger workers (and fewer older workers), the participation rate might move up some more.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 5.7 million, changed little in November but was down by 416,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons declined in November, and this is the lowest level since June 2008. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 9.3% in November. This is the lowest level for U-6 since April 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.856 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.979 million in October.

This is trending down, and is at the lowest level since July 2008.

Overall this was another solid report.