Mortgage applications increased 4.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 20, 2017. This week’s results included an adjustment for the MLK Day holiday.

... The Refinance Index increased 0.2 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier to its highest level since June 2016. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 0.1 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,000 or less) increased to 4.35 percent from 4.27 percent, with points decreasing to 0.30 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

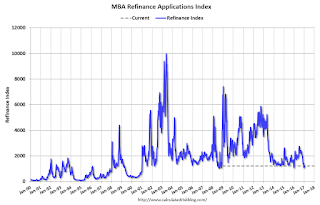

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity - although we might see more cash-out refis.

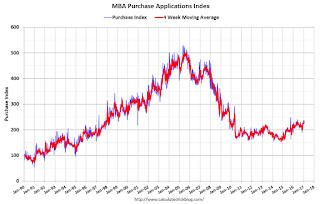

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates, purchase activity is still holding up - this is the highest level for the index since June 2016.

However refinance activity has declined significantly.