by Calculated Risk on 2/25/2017 09:31:00 AM

Saturday, February 25, 2017

Schedule for Week of Feb 26, 2017

The key economic report this week is the second estimate of Q4 GDP.

Other key indicators include the February ISM manufacturing and non-manufacturing indexes, February auto sales, and the Case-Shiller house price index.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.8% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 1.1% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

8:30 AM: Gross Domestic Product, 4th quarter 2016 (second estimate). The consensus is that real GDP increased 2.1% annualized in Q4, up from advance estimate of 1.9%..

9:00 AM ET: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the November 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.4% year-over-year increase in the Comp 20 index for December.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 52.9, up from 54.6 in December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. This is the last of the regional Fed surveys for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

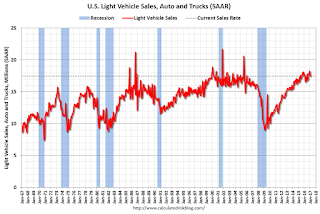

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 17.7 million SAAR in February, from 17.5 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 17.7 million SAAR in February, from 17.5 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 56.1, up from 54.7 in December.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 56.1, up from 54.7 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 56.0% in January. The employment index was at 56.1%, and the new orders index was at 60.4%.

10:00 AM: Construction Spending for January. The consensus is for a 0.2% increase in construction spending.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand the previous week.

10:00 AM: the ISM non-Manufacturing Index for February. The consensus is for index to increase to 57.2 from 57.1 in December.

2:00 PM: Speech by Fed Chair Janet Yellen, Economic Outlook, At the Executives Club of Chicago, Chicago, Ill.