For manufacturing, March industrial production, and the April New York, and Philly Fed manufacturing surveys, will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 15.0, down from 16.4.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 70, down from 71 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for March.

8:30 AM: Housing Starts for March. This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low).

The consensus is for 1.262 million, down from the February rate of 1.288 million.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.0%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 26.0, down from 32.8.

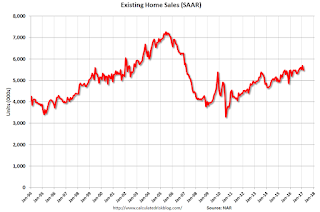

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.61 million SAAR, up from 5.48 million in February.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.61 million SAAR, up from 5.48 million in February.10:00 AM: Regional and State Employment and Unemployment (Monthly) for March 2017