by Calculated Risk on 5/16/2017 10:39:00 AM

Tuesday, May 16, 2017

MBA: Mortgage Delinquencies Decreased in Q1, Foreclosures Decreased

From the MBA: Delinquencies Decline in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one- to four-unit residential properties decreased to a seasonally adjusted rate of 4.71 percent of all loans outstanding at the end of the first quarter of 2017. The delinquency rate was down nine basis points from the previous quarter, and was six basis points lower than one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the first quarter was 0.30 percent, an increase of two basis points from the previous quarter, but five basis points lower than one year ago.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 1.39 percent, down 14 basis points from the fourth quarter and 35 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.76 percent, a decrease of 37 basis points from last quarter, and a decrease of 53 basis points from last year.

Marina Walsh, MBA's Vice President of Industry Analysis, offered the following commentary on the survey:

"Mortgage delinquencies decreased overall in the first quarter of 2017, driven by a drop in both the FHA and VA delinquency rates from the previous quarter as the conventional delinquency rate held constant. Employment growth started 2017 on strong footing, with the economy adding 216,000 jobs in January 2017 and 232,000 jobs in February. Average hourly wage growth increased 2.8 percent over the year, and has maintained a generally increasing trend since late 2015. These fundamentals have helped to support the performance of all loan types - whether FHA, VA or conventional loans.

...

"In addition, nearly all states had a decrease in the percentage of loans in foreclosure in the first quarter. The overall percentage of loans in the process of foreclosure was 1.39 percent, its lowest level since the first quarter of 2007. While judicial states still had more than three times the percent of loans in foreclosure as non-judicial states, that measure declined to the lowest level since the fourth quarter of 2007."

emphasis added

Click on graph for larger image.

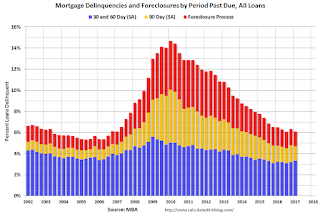

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Note that the total percent delinquencies and foreclosures is below the 2002 level.

The percent of loans 30 and 60 days delinquent increased in Q1, but is below the normal historical level.

The 90 day bucket decreased in Q1, but remains a little elevated.

The percent of loans in the foreclosure process continues to decline, but is still above the historical average.

The 90 day bucket and foreclosure inventory are still elevated, but should be close to normal in 2017. Most other mortgage measures are already back to normal, however the lenders are still working through the backlog of bubble legacy loans - especially in judicial foreclosure states.