by Calculated Risk on 6/05/2017 11:33:00 AM

Monday, June 05, 2017

Black Knight Mortgage Monitor: "Q1 2017 Originations Fall 34 Percent, Led By 45 Percent Drop in Refinance Lending"

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for April today. According to BKFS, 4.08% of mortgages were delinquent in April, down from 4.24% in April 2016. BKFS also reported that 0.85% of mortgages were in the foreclosure process, down from 1.17% a year ago.

This gives a total of 4.93% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Q1 2017 Originations Fall 34 Percent, Led By 45 Percent Drop in Refinance Lending; Despite Recent Rate Softening, Home Affordability Remains Near Post-Recession Low

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of April 2017. This month, Black Knight looked at Q1 2017 purchase and refinance originations, finding significant quarterly declines in volume among both. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the declines are rooted in the upward interest rate shift seen in Q4 2016.

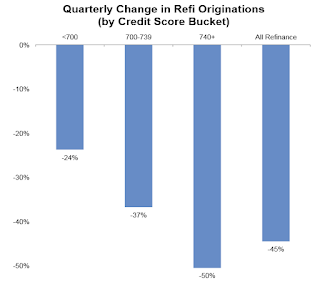

“Overall, first lien mortgage originations fell by 34 percent in the first quarter of 2017,” said Graboske. “As expected, the decline was most pronounced in the refinance market, which saw a 45 percent decline from Q4 2016 and were down 20 percent from last year. They also made up a smaller share of overall originations than in the past; just 45 percent of total Q1 originations were refinances vs. 54 percent in Q4 2016. Purchase originations were also down 21 percent from Q4 2016, although the first quarter is historically the calendar-year low for such lending. Purchase lending was up year-over-year, but the three percent annual growth is a marked decline from Q4 2016’s 12 percent, and marks the slowest growth rate Black Knight has observed in more than three years – going back to Q4 2013. At that point in time, interest rates had risen abruptly – very similarly to what we saw at the end of 2016 – and originations slowed considerably. The same dynamic is at work here.

“Likewise, refinance lending among higher-credit-score borrowers, who have largely driven the refinance market these past several years, saw a quarterly decline of 50 percent. As we’ve seen in the past, these borrowers tend to strike quickly and often when interest rate incentives are present, but tend to hold back when the conditions are less favorable. At the other end of the credit spectrum, lower credit borrowers – those with credit scores below 700 – only saw refinance volumes decrease by 24 percent. Again, we saw a similar phenomenon when rates rose in late 2013/early 2014. This is worth noting as we monitor the future performance of 2017 originations. Not only are refinances -- which generally tend to outperform purchase mortgages -- making up a smaller share of the market, but there’s also been a net lowering of average credit scores as well. The average Q1 2017 refinance credit score was 742, down from 751 in Q4 2016, and the lowest average credit score since Q3 2014. Both of these factors could have a dampening factor on mortgage performance, holistically speaking.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the refinance volume by credit score.

From Black Knight:

• Higher credit score borrowers (740 and up) saw the greatest decline in refinance activity, with origination volumes declining by 50 percent

• At the other end of the spectrum, refinance lending to lower credit borrowers – those with credit scores below 700 – decreased by 24 percent

• A similar phenomenon was observed in late 2013/early 2014 when interest rates had also risen abruptly, in a very similar fashion to what was observed at the end of 2016

This graph from Black Knight shows the change in refinance origination by credit score.

This graph from Black Knight shows the change in refinance origination by credit score. From Black Knight:

• Refinances – which generally tend to outperform purchase mortgages – are making up a smaller share of the market, accounting for 45 percent of total Q1 originations vs. 54 percent in Q4 2016There is much more in the mortgage monitor.

• There’s been a net lowering of average credit scores as well, with the average Q1 refinance credit score coming in at 742, down from 751 in Q4 2016, and the lowest average credit score since Q3 2014

• Both of these factors could have a dampening factor on mortgage performance holistically speaking and are worth noting as we monitor future performance of 2017 originations