by Calculated Risk on 6/08/2017 03:49:00 PM

Thursday, June 08, 2017

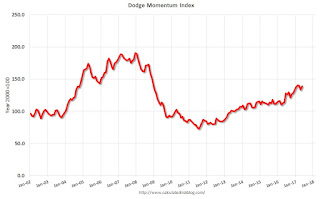

Leading Index for Commercial Real Estate Increases in May

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Resumes Growth in May

Following a dip in April, the Dodge Momentum Index advanced 4.0% in May to 139.1 (2000=100) from its revised April reading of 133.7. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In May, the commercial component of the Momentum Index increased 4.8% to an eight-and-a-half year high, which suggests that construction activity for commercial buildings will continue to rise over the next year, even with signs of decelerating improvement in market fundamentals (occupancies and rents). The institutional component of the Momentum Index rose 2.9% in May, making a partial rebound after pulling back 12.0% in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 139.1 in May, up from 133.7 in April.

The index is up solidly year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.