by Calculated Risk on 3/31/2018 08:11:00 AM

Saturday, March 31, 2018

Schedule for Week of Apr 1, 2018

The key report this week is the March employment report on Friday.

Other key indicators include the February Trade deficit, March ISM manufacturing and non-manufacturing indexes, March auto sales, and the March ADP employment report.

Fed Chair, Jerome Powell, will speak on the Economic Outlook on Friday.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 60.0, down from 60.8 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 60.0, down from 60.8 in February.Here is a long term graph of the ISM manufacturing index.

The PMI was at 60.8% in February, the employment index was at 59.7%, and the new orders index was at 64.2%.

10:00 AM: Construction Spending for February. The consensus is for a 0.5% increase in construction spending.

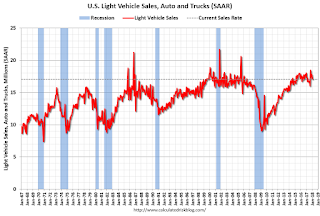

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 17.0 million SAAR in March, down from 17.1 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 17.0 million SAAR in March, down from 17.1 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

10:00 AM: Corelogic House Price index for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in March, down from 235,000 added in February.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 59.0 from 59.5 in February.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, up from 215 thousand the previous week.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through December. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $56.8 billion in February from $56.8 billion in January.

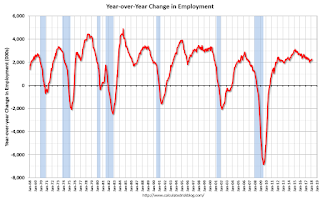

8:30 AM: Employment Report for March. The consensus is for an increase of 167,000 non-farm payroll jobs added in March, down from the 313,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to decrease to 4.0%.

The consensus is for the unemployment rate to decrease to 4.0%.This graph shows the year-over-year change in total non-farm employment since 1968.

In February the year-over-year change was 2.281 million jobs.

A key will be the change in wages.

1:30 PM: Speech by Fed Chair Jerome Powell, Economic Outlook, At the Economic Club of Chicago, Chicago, Illinois

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $15.0 billion in February.

Friday, March 30, 2018

Fannie Mae: Mortgage Serious Delinquency rate decreased slightly in February

by Calculated Risk on 3/30/2018 04:23:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 1.22% in February, down from 1.23% in January. The serious delinquency rate is up from 1.19% in February 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 3.35% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 6.49% are seriously delinquent, For recent loans, originated in 2009 through 2017 (91% of portfolio), only 0.53% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q1 GDP Forecasts

by Calculated Risk on 3/30/2018 03:32:00 PM

Here are few Q1 GDP forecast.

From Merrill Lynch:

The data sliced 0.3pp from 1Q GDP tracking, bringing it down to 1.6%. [March 29 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 2.4 percent on March 29, up from 1.8 percent on March 23. The forecast of the contribution of inventory investment to first-quarter real GDP growth increased from 0.66 percentage points to 1.21 percentage points after yesterday’s advance releases of wholesale and retail inventories by the U.S. Census Bureau, yesterday's GDP release by the U.S. Bureau of Economic Analysis (BEA), and this morning's release of the revised underlying detail tables for the National Income and Product Accounts by the BEA.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.7% for 2018:Q1 and 2.9% for 2018:Q2. [March 30 estimate]CR Note: It looks like another quarter around 2% or so, although there might still be some residual seasonality in the first quarter.

Hotels: Occupancy Rate Up Year-over-Year

by Calculated Risk on 3/30/2018 12:53:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 24 March

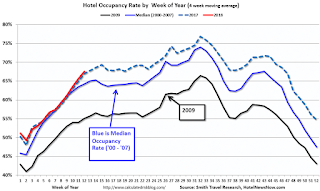

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 18-24 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 19-25 March 2017, the industry recorded the following:

• Occupancy: +1.0 at 69.4%

• Average daily rate (ADR): +4.4% to US$133.42

• Revenue per available room (RevPAR): +5.4% to US$92.53

STR analysts note that performance in many major markets was boosted by strong group business, which moved out of the week of 25-31 March due to an earlier Easter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is third overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Reis: Mall Vacancy Rate increased slightly in Q1 2018

by Calculated Risk on 3/30/2018 09:47:00 AM

Reis reported that the vacancy rate for regional malls was 8.4% in Q1 2018, up from 8.3% in Q4 2017, and up from 7.9% in Q1 2017. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.0% in Q1, unchanged from 10.0% in Q4, and up from 9.9% in Q1 2017. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis:

Despite continued announcements of store closures, the Neighborhood and Community Shopping Center vacancy rate remained at 10% for the fourth consecutive quarter, up from 9.9% in the first quarter of 2017. The vacancy rate has increased 20 basis points from a low of 9.8% in Q2 2016.

On the national level, both asking and effective rents increased 0.4% in the first quarter. At $20.96 and $18.34 per square foot, the average market and effective rents have increase 1.9% and 2.1% year-over-year, respectively.

Net absorption was 453,000 square feet, the lowest quarterly total in more than five years. Construction was also much lower than average: 712,000 square feet, well below the 3.1 million square feet quarterly average in 2017. The first quarter tends to see the lowest activity; however, this was an unusually slow quarter for retail leasing and construction.

The mall vacancy rate increased to 8.4% in the quarter, up 50 basis points from 7.9% in the first quarter of 2017. The quarterly rent increase of 0.5% shrouds the gap between the higher-end malls, which are thriving, and the increasingly vacant lower-end malls.

...

Although the retail real estate market survived the tsunami of closures in 2017, the closures expected in the second quarter from Toys “R” Us, BI-LO and others will be a true test of the retail sector’s ability to weather the ongoing storm.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased from an already elevated level.

Mall vacancy data courtesy of Reis

Thursday, March 29, 2018

"Mortgage Rates Unchanged Despite Market Improvements"

by Calculated Risk on 3/29/2018 06:36:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged Despite Market Improvements

Mortgage rates were generally unchanged today, although a few lenders offered slight improvements. This stands in contrast to the noticeable improvements in underlying bond markets. As we discussed yesterday, Treasury yields are leading the charge toward lower rates, and while the bonds that underlie mortgages are definitely lagging that move, they're improving nonetheless. But again, you wouldn't really know it based on today's rate sheets. [30YR FIXED - 4.5%]Here is a table from Mortgage News Daily:

emphasis added

Merrill and Nomura Forecasts for March Employment Report

by Calculated Risk on 3/29/2018 04:06:00 PM

Here are some excepts from two research reports ... first from Merrill Lynch:

We expect nonfarm payrolls to increase by 195k and private payrolls to increase by 200k in March ...From Nomura:

We expect to see employment activity return back closer to trend after last month’s unexpected gain of 313k which was likely boosted by warmer weather conditions. As such, we could see some softening in goods-producing jobs, such as construction, which were particularly strong in February. Elsewhere, we expect negative payback in government payrolls in March after an outsized gain in February due to strong hiring activity in local government education payrolls. Therefore, we expect the gains in private payrolls to outpace the gains in nonfarm payrolls.

We look for the unemployment rate ... to remain unchanged at 4.1%, which would mark the sixth consecutive month at that level. ...

... note that while the inclement weather likely reduced hours worked in March, it’s unlikely to impact payrolls growth noticeably as the BLS counts the number workers on payroll during the pay period capturing the 12th of the month. The decline in hours worked should result in an upward bias to wage growth, leading us to forecast average hourly earnings to increase by 0.3% mom, pushing up the yoy comparison to 2.8% from 2.6%.

We expect nonfarm payroll employment in March to increase by 115k, a below-trend reading primarily due to negative payback from February’s weather-related boost. ... According to the San Francisco Fed’s weather payroll model, warmer weather biased up February payroll employment by roughly 90k, largely accounting for the above-consensus print of 313k in February. ...I'll write an employment report preview next week after more data for March is released.

We forecast a 0.2% m-o-m increase in average hourly earnings (AHE), corresponding to 2.7% on a 12-month basis. ... Finally, we expect the unemployment rate to decline 0.1pp to 4.0% ... However, there is some risk that the unemployment rate declines below 4.0% given an unusual increase in labor force inflows in February

Earlier: Chicago PMI Declines in March

by Calculated Risk on 3/29/2018 01:59:00 PM

From the Chicago PMI: March Chicago Business Barometer Eases to 57.4

The MNI Chicago Business Barometer fell 4.5 points to 57.4 in March, down from 61.9 in February, hitting the lowest level in exactly one year.This was well below the consensus forecast of 63.2, but still a decent reading.

Firms’ operations continued to expand in March, but the pace of expansion moderated for a third straight month. Three of the five Barometer components receded on the month, with only Employment and Supplier Deliveries expanding.

...

“The Chicago Business Barometer calendar quarter average had increased for six straight quarters until Q1 2018, with the halt largely due to the recent downward trajectory of orders and output,” said Jamie Satchi, Economist at MNI Indicators.

“Troubles higher up in firms’ supply chains are restraining their productive capacity and higher prices are being passed on to consumers. On a more positive note, firms remain keen to expand their workforce,” he added.

emphasis added

Reis: Office Vacancy Rate increased in Q1 to 16.5%

by Calculated Risk on 3/29/2018 11:25:00 AM

Reis released their Q1 2018 Office Vacancy survey this morning. Reis reported that the office vacancy rate increased to 16.5% in Q1, from 16.4% in Q4 2017. This is up from 16.3% in Q1 2017, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

Defying a healthy job market, the office vacancy rate increased in the first quarter to 16.5%, up from 16.4% at year-end 2017 and 16.3% in the first quarter of 2017. The vacancy rate has increased 30 basis points from a low of 16.2% in Q4 2016.

The national average asking rent increased 0.8% in the first quarter while effective rents, which net out landlord concessions, increased 0.9%. At $32.87 and $26.67 per square foot, respectively, the average market and effective rents have both increased 2.2% from the first quarter of 2017.

Net absorption was 6.2 million square feet, which was above the average quarterly absorption level of 2017: 5.9 million square feet. Construction was also higher than average: 10.9 million square feet, above 10.6 million square feet per quarter in 2017. Moreover, the first quarter tends to see the lowest activity; thus, this was a relatively strong quarter given the Nor’easters that plagued the Northeast.

...

Moreover, the market seemed to have stagnated in 2017 as companies had put off making office leasing decisions until a fiscal stimulus was passed. The passing of the Tax Reform and Jobs Act should deliver higher profits and stronger business confidence which should spur stronger office leasing this year.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.5% in Q1. The office vacancy rate has been mostly moving sideways at an elevated level, but has increased a little recently.

Office vacancy data courtesy of Reis.

Personal Income increased 0.4% in February, Spending increased 0.2%

by Calculated Risk on 3/29/2018 08:48:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $67.3 billion (0.4 percent) in February according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $53.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $27.7 billion (0.2 percent).The February PCE price index increased 1.8 percent year-over-year (up from 1.7 percent YoY in January) and the February PCE price index, excluding food and energy, increased 1.6 percent year-over-year (up from 1.5 percent YoY in January).

Real DPI increased 0.2 percent in February and Real PCE increased less than 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through February 2018 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly below expectations, and the increase in PCE was slightly above expectations.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 1.4% annual rate in Q1 2018. (using the mid-month method, PCE was increasing 0.4%). This suggests weak PCE growth in Q1.

Weekly Initial Unemployment Claims decrease to 215,000

by Calculated Risk on 3/29/2018 08:34:00 AM

The DOL reported:

In the week ending March 24, the advance figure for seasonally adjusted initial claims was 215,000, a decrease of 12,000 from the previous week's revised level. This is the lowest level for initial claims since January 27, 1973 when it was 214,000. The previous week's level was revised down by 2,000 from 229,000 to 227,000. The 4-week moving average was 224,500, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 1,250 from 223,750 to 225,000.The previous week was revised down.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,500.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, March 28, 2018

Thursday: Personal Income and Outlays, Unemployment Claims, Chicago PMI and More

by Calculated Risk on 3/28/2018 08:12:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 229 thousand the previous week.

• Also at 8:30 AM, Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 63.2, up from 61.9 in February.

• During the Day, Reis Q1 2018 Office Survey of rents and vacancy rates.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 102.0, unchanged from 102.0 in February.

Zillow Case-Shiller Forecast: More Solid House Price Gains in February

by Calculated Risk on 3/28/2018 04:07:00 PM

The Case-Shiller house price indexes for January were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: January Case-Shiller Results and February Forecast: Prelude to Home Buying Season Already Hot

The continuing inventory pinch helped boost the U.S. national Case Shiller index 6.2 percent in January from a year earlier, down from a 6.3 percent gain in December. Case-Shiller’s 10-City Composite rose 6 percent, while the 20-City Composite climbed 6.4 percent year-over-year.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be slightly less in February than in January.

...

Spring home shopping season will be in full swing soon, and with it we can expect the usual seasonal bump of would-be home buyers competing over a shrinking pool of homes. But in a twist, this year’s buyers may be competing against some buyers who have been unsuccessful in recent months.

Increasingly, the traditional seasonal boundaries around home shopping season – which generally heats up in early spring and cools off by late summer, in time for back-to-school season – are becoming less pronounced.

Limited supply, fierce competition and rising prices are forcing many buyers to stay on the market longer in hopes of finding the right home at the right price. More inventory is really the only cure for those pressures right now, especially for people at the entry-level end of the market, but it has proven frustratingly slow in coming.

...

Right now, the market can barely absorb what current demand there is. It remains to be seen how it adapts to even more buyers, and presumably less inventory, in the months to come.

Zillow predicts the February S&P/Case-Shiller U.S. national index, released April 24, will climb 6 percent year-over year.

Reis: Apartment Vacancy Rate increased in Q1 to 4.7%

by Calculated Risk on 3/28/2018 12:25:00 PM

Reis reported that the apartment vacancy rate was at 4.7% in Q1 2018, up from 4.6% in Q4, and up from 4.3% in Q1 2017. This is the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

Continuing on its upward path, the apartment vacancy rate increased to 4.7% from 4.6% at year-end 2017 and 4.3% in the first quarter of 2017. The vacancy rate has increased 60 basis points from a low of 4.1% in Q3 2016.

The national average asking rent increased 0.9% in the first quarter while effective rents, which net out landlord concessions, increased 0.8%. At $1,382 (market) and $1,318 (effective) per unit, the average rents have increased 4.4% and 3.9%, respectively, from the first quarter of 2017.

Net absorption was 27,875 units, well below the average quarterly absorption of 2017 of 44,707 units. Construction was also low at 39,917 units, trailing the 2017 quarterly average of 58,824 units. We caution that the first quarter tends to see the lowest activity, but this was particularly low given the construction pipeline.

...

Although many metros are expected to see considerably higher levels of completions in 2018 – including Dallas, New York, Los Angeles, Denver and Atlanta – the expected increase in vacancy is not expected to exceed 2.5% in any market as job growth is expected to remain healthy in most metros fueling the demand for apartments.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. However, the vacancy rate has bottomed and is starting to increase. With more supply coming on line - and less favorable demographics - the vacancy rate will probably continue to increase in 2018.

Apartment vacancy data courtesy of Reis.

NAR: Pending Home Sales Index Increased 3.1% in February, Down 4.1% Year-over-year

by Calculated Risk on 3/28/2018 10:04:00 AM

From the NAR: Pending Home Sales Reverse Course in February, Rise 3.1 Percent

Pending home sales snapped back in much of the country in February, but weakening affordability and not enough inventory on the market restricted overall activity compared to a year ago, according to the National Association of Realtors®.This was above expectations of a 2.7% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, grew 3.1 percent to 107.5 in February from a downwardly revised 104.3 in January. Even with last month’s increase in activity, the index is 4.1 percent below a year ago.

...

The PHSI in the Northeast surged 10.3 percent to 96.0 in February, but is still 5.1 percent below a year ago. In the Midwest the index inched forward 0.7 percent to 98.9 in February, but is 9.5 percent lower than February 2017.

Pending home sales in the South rose 3.0 percent to an index of 125.7 in February, but are 1.5 percent lower than last February. The index in the West climbed 0.4 percent in February to 96.9, but is 2.2 percent below a year ago.

emphasis added

Q4 GDP Revised up to 2.9% Annual Rate

by Calculated Risk on 3/28/2018 08:38:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter and Annual 2017 (Third Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2017, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.Here is a Comparison of Third and Second Estimates. PCE growth was up to 4.0% from 3.8%. Residential investment was revised down from 13.0% to 2.8%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.5 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains the same; personal consumption expenditures (PCE) and private inventory investment were revised up.

emphasis added

MBA: Purchase Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/28/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 23, 2018.

... The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 8 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.69 percent from 4.68 percent, with points decreasing to 0.43 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 8% year-over-year.

Tuesday, March 27, 2018

Wednesday: GDP, Pending Home Sales

by Calculated Risk on 3/27/2018 07:42:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 4th quarter 2017 (Third estimate). The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from the second estimate of 2.3%.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 2.7% increase in the index.

• During the Day, Reis Q1 2018 Apartment Survey of rents and vacancy rates.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased Slightly in February

by Calculated Risk on 3/27/2018 04:49:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was 1.06%, down from 1.07% in January. Freddie's rate is up from 0.98% in February 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to a cycle bottom in the 0.5% to 0.8% range.

Note: Fannie Mae will report for February soon.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 3/27/2018 04:41:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

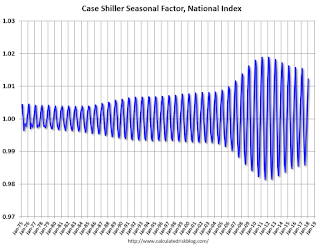

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through January 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Real House Prices and Price-to-Rent Ratio in January

by Calculated Risk on 3/27/2018 01:01:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in January

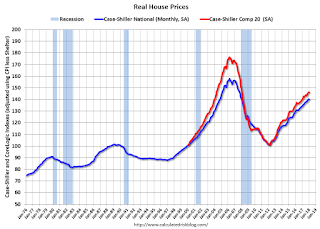

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 7.6% above the previous bubble peak. However, in real terms, the National index (SA) is still about 11.1% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In January, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $284,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

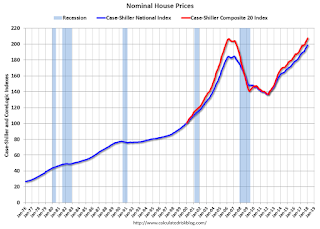

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to November 2004 levels, and the Composite 20 index is back to April 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to January 2004 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004 - and the price-to-rent ratio has been increasing slowly.

Richmond Fed: "Fifth District Manufacturing Firms Reported Sluggish Growth in March"

by Calculated Risk on 3/27/2018 10:13:00 AM

From the Richmond Fed: Fifth District Manufacturing Firms Reported Sluggish Growth in March

Fifth District manufacturing expanded at a slower pace in March, according to the most recent survey results from the Federal Reserve Bank of Richmond. The composite index dropped from a particularly strong reading of 28 in February to 15 in March as each of the three components (shipments, new orders, and employment) fell. However, for each of these variables, a larger share of firms predicted growth in six months than had in February. Firms reported weaker growth in capital expenditures in March but saw an uptick in growth of business services expenditures.This was the last of the regional Fed surveys for March.

The survey's employment measures suggested slower growth in March. While the availability of skills index increased in March, it remained in negative territory indicating that skills shortages persisted. Firms anticipate stronger growth in all employment measures in the coming months.

District manufacturers saw higher growth in prices paid in March, but growth in prices received slowed slightly. However, firms expected to see accelerating price increases for both prices paid and received in the next six months.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be solid again in March, but probably lower than in February (to be released Monday, April 2nd).

Case-Shiller: National House Price Index increased 6.2% year-over-year in January

by Calculated Risk on 3/27/2018 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller National Home Prices: All 20 Cities Up Year-over-year

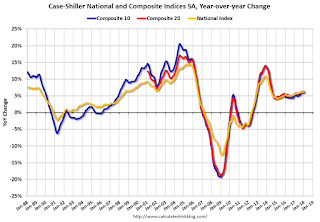

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in January, down from 6.3% in the previous month. The 10-City Composite annual increase came in at 6.0%, no change from the previous month. The 20-City Composite posted a 6.4% year-over-year gain, up from 6.3% in the previous month.

Seattle, Las Vegas, and San Francisco reported the highest year-over-year gains among the 20 cities. In January, Seattle led the way with a 12.9% year-over-year price increase, followed by Las Vegas with an 11.1% increase and San Francisco with a 10.2% increase. Twelve of the 20 cities reported greater price increases in the year ending January 2018 versus the year ending December 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.05% in January. The 10-City and 20-City Composites both reported increases of 0.3%. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase in January. The 10-City and 20-City Composites posted 0.7% and 0.8% month-over-month increases, respectively. Sixteen of the 20 cities reported increases in January before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“The home price surge continues,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Since the market bottom in December 2012, the S&P Corelogic Case-Shiller National Home Price index has climbed at a 4.7% real – inflation adjusted – annual rate. That is twice the rate of economic growth as measured by the GDP. While price gains vary from city to city, there are few, if any, really weak spots. Seattle, up 12.9% in the last year, continues to see the largest gains, followed by Las Vegas up 11.1% over the same period. Even Chicago and Washington, the cities with the smallest price gains, saw a 2.4% annual increase in home prices.

“Two factors supporting price increases are the low inventory of homes for sale and the low vacancy rate among owner-occupied housing. The current months-supply -- how many months at the current sales rate would be needed to absorb homes currently for sale -- is 3.4; the average since 2000 is 6.0 months, and the high in July 2010 was 11.9. Currently, the homeowner vacancy rate is 1.6% compared to an average of 2.1% since 2000; it peaked in 2010 at 2.7%. Despite limited supplies, rising prices, and higher mortgage rates, affordability is not a concern. Affordability measures published by the National Association of Realtors show that a family with a median income could comfortably afford a mortgage for a median priced home.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 2.4% from the peak, and up 0.7% in January (SA).

The Composite 20 index is up slightly from the bubble peak, and up 0.8% (SA) in January.

The National index is 7.6% above the bubble peak (SA), and up 0.5% (SA) in January. The National index is up 45.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.9% compared to January 2017. The Composite 20 SA is up 6.3% year-over-year.

The National index SA is up 6.1% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, March 26, 2018

Tuesday: Case-Shiller House Prices

by Calculated Risk on 3/26/2018 05:57:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher to Begin Shortened Week

Mortgage rates moved sideways to slightly higher today, keeping them in an exceptionally narrow range that's persisted for the entire month of March. As of last Thursday, rates looked like they might make an attempt to challenge the lower boundary of that range, but they quickly backed off (or backed "up" as the case may be). Friday and today have seen a fairly steady move back toward the middle of March's range.Tuesday:

Context is also important. While we can talk about "movement" in a literal sense in the past few days, for all practical purposes, the average mortgage seeker wouldn't be seeing much of a difference. [30YR FIXED - 4.5-4.625%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 6.2% year-over-year increase in the Comp 20 index for January.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

Vehicle Sales Forecast: Sales Under 17 Million SAAR in March

by Calculated Risk on 3/26/2018 02:56:00 PM

The automakers will report March vehicle sales on Tuesday, April 3rd.

Note: There were 28 selling days in March 2018, up from 27 in March 2017.

From WardsAuto: U.S. Light-Vehicle Forecast: Sales Down Slightly; Inventory Declines to Match Demand

A Wards Intelligence forecast calls for U.S. automakers to deliver 1.60 million light vehicles in March. ... The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, higher than last year’s 16.7 million but slightly under last month’s 17.0 million.Sales in March will probably be at the slowest sales rate since last August. After August, sales were boosted by the hurricanes.

emphasis added

Black Knight: National Mortgage Delinquency Rate Decreased Slightly in February

by Calculated Risk on 3/26/2018 12:42:00 PM

From Black Knight: Black Knight’s First Look at February 2018 Mortgage Data

• The national delinquency rate edged slightly downward in February, with hurricane-related delinquencies declining by a modest 5.0 percent for the monthAccording to Black Knight's First Look report for February, the percent of loans delinquent decreased 0.2% in February compared to January, and increased 2.1% year-over-year.

• Serious delinquencies (90 or more days past due) attributed to Hurricanes Harvey and Irma fell just 3.0 percent

• 128,000 hurricane-driven seriously delinquent mortgages remain in Texas, Florida, and Georgia

• After hitting a 12-month high in January, foreclosure starts fell 25 percent month-over-month

• Active foreclosure inventory rebounded from January’s increase, reaching a new post-recession low

• Rising interest rates pushed prepayment activity to the lowest level since 2014

The percent of loans in the foreclosure process decreased 1.8% in February and were down 30% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.30% in February, down from 4.31% in January.

The percent of loans in the foreclosure process decreased slightly in February to 0.65%.

The number of delinquent properties, but not in foreclosure, is up 63,000 properties year-over-year, and the number of properties in the foreclosure process is down 139,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2018 | Jan 2018 | Feb 2017 | Feb 2016 | |

| Delinquent | 4.30% | 4.31% | 4.21% | 4.45% |

| In Foreclosure | 0.65% | 0.66% | 0.93% | 1.30% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,198,000 | 2,202,000 | 2,135,000 | 2,252,000 |

| Number of properties in foreclosure pre-sale inventory: | 331,000 | 337,000 | 470,000 | 655,000 |

| Total Properties | 2,528,000 | 2,539,000 | 2,605,000 | 2,907,000 |

Dallas Fed: "Texas Manufacturing Expansion Continues but at a Slower Pace"

by Calculated Risk on 3/26/2018 10:36:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues but at a Slower Pace

Texas factory activity continued to expand in March, albeit at a markedly slower pace than last month, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell 15 points to 12.7, signaling a deceleration in output growth.This is still a solid report. So far all of the regional surveys have been solid in March.

Other indexes of manufacturing activity also remained positive but posted double-digit declines in March. The new orders and growth rate of orders indexes fell to 8.3 and 3.8, respectively. The capacity utilization index dropped to 9.6, and the shipments index plunged 23 points to 9.3. Although these indexes are down notably from their February readings, they remain well above their postrecession averages.

Perceptions of broader business conditions remained positive on net, but the share of firms reporting an improvement declined from last month. The general business activity index fell 16 points to 21.4, and the company outlook index declined 12 points to 19.6. While both of these March readings represent the lowest this year, they are on par with last year’s average indexes and far above their postrecession average levels.

Labor market measures suggested growth was weaker for employment and workweek length. The employment index came in at 10.8, down eight points from February. Twenty percent of firms noted net hiring, compared with 9 percent noting net layoffs. The hours worked index moved down to 9.4.

emphasis added

Chicago Fed "Index points to a pickup in economic growth in February"

by Calculated Risk on 3/26/2018 09:28:00 AM

From the Chicago Fed: Index points to a pickup in economic growth in February

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.88 in February from +0.02 in January. All four broad categories of indicators that make up the index increased from January, and three of the four categories made positive contributions to the index in February. The index’s three-month moving average, CFNAI-MA3, increased to +0.37 in February from +0.16 in January.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in February (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, March 25, 2018

Sunday Night Futures

by Calculated Risk on 3/25/2018 07:20:00 PM

Weekend:

• Schedule for Week of Mar 25, 2018

Monday:

• At 8:30 AM ET Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 7, and DOW futures are up 80 (fair value).

Oil prices were up over the last week with WTI futures at $65.86 per barrel and Brent at $70.50 per barrel. A year ago, WTI was at $48, and Brent was at $51 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.61 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 32 cents per gallon year-over-year.

Hotels: Occupancy Rate Up Year-over-Year

by Calculated Risk on 3/25/2018 08:41:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 17 March

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 11-17 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 March 2017, the industry recorded the following:

• Occupancy: +1.0 at 70.7%

• Average daily rate (ADR): +2.8% to US$133.76

• Revenue per available room (RevPAR): +3.9% to US$94.55

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is fifth overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, March 24, 2018

Schedule for Week of Mar 25, 2018

by Calculated Risk on 3/24/2018 11:11:00 AM

The key economic reports this week are the third estimate of Q4 GDP, Personal Income and Outlays for February, and Case-Shiller house prices.

Also the Q1 quarterly Reis surveys for office and malls will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for January.

9:00 AM ET: S&P/Case-Shiller House Price Index for January.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for January.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q1 2018 Apartment Survey of rents and vacancy rates.

8:30 AM: Gross Domestic Product, 4th quarter 2017 (Third estimate). The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from the second estimate of 2.3%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 2.7% increase in the index.

Early: Reis Q1 2018 Office Survey of rents and vacancy rates.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 229 thousand the previous week.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 63.2, up from 61.9 in February.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 102.0, unchanged from 102.0 in February.

Early: Reis Q1 2018 Mall Survey of rents and vacancy rates.

Off-topic: "March, Vote, Change the World!"

by Calculated Risk on 3/24/2018 08:11:00 AM

To find a local march, here is the March for Our Lives website. Make a difference today!

A stunning article from the WaPo: U.S. School Shootings

Beginning with Columbine in 1999, more than 187,000 students attending at least 193 primary or secondary schools have experienced a shooting on campus during school hours, according to a year-long Washington Post analysis. This means that the number of children who have been shaken by gunfire in the places they go to learn exceeds the population of Eugene, Ore., or Fort Lauderdale, Fla.March. Vote. Change the World.

Friday, March 23, 2018

Oil Rigs "Signs of life in the minor plays"

by Calculated Risk on 3/23/2018 06:58:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 23, 2018:

• Total US oil rigs were up this week, +4 to 804

• Horizontal oil rigs were up, +1 to 708

...

• The Permian continues to perform relatively well overall, although only one horizontal rig has been added there in the last six weeks.

• The Cana Woodford was absolutely hammered again, now below its July peak

• The minor ‘Other’ plays have come back to life, with horizontal oil rigs there above last July’s peak for the first time

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Phoenix Real Estate in February: Sales up 8%, Inventory down 12% YoY

by Calculated Risk on 3/23/2018 03:40:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in February were up 7.7% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 12.1% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller. With flat inventory in 2016, prices were up 4.8%.

This is the sixteenth consecutive month with a YoY decrease in inventory, and prices rose a little faster in 2017 compared to 2016 (5.6% in 2017 compared to 4.8% in 2016).

| February Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Feb-2008 | 3,445 | --- | 650 | 18.9% | 57,3051 | --- |

| Feb-2009 | 5,477 | 59.0% | 2,188 | 39.9% | 52,013 | -9.2% |

| Feb-2010 | 6,595 | 20.4% | 2,997 | 45.4% | 42,388 | -18.5% |

| Feb-2011 | 7,171 | 8.7% | 3,776 | 52.7% | 40,666 | -4.1% |

| Feb-2012 | 7,249 | 1.1% | 3,616 | 49.9% | 23,736 | -41.6% |

| Feb-2013 | 6,618 | -8.7% | 3,053 | 46.1% | 21,718 | -8.5% |

| Feb-2014 | 5,476 | -17.3% | 1,939 | 35.4% | 29,899 | 37.7% |

| Feb-2015 | 5,970 | 9.0% | 1,784 | 29.9% | 27,382 | -8.4% |

| Feb-2016 | 5,816 | -2.6% | 1,688 | 29.0% | 27,202 | -0.7% |

| Feb-2017 | 6,547 | 12.6% | 1,696 | 25.9% | 24,275 | -10.8% |

| Feb-2018 | 7,052 | 7.7% | 1,978 | 28.0% | 21,339 | -12.1% |

| 1 February 2008 probably included pending listings | ||||||

BLS: Unemployment Rates Lower in 7 states in February; California, Maine, Mississippi and Wisconsin at New Series Lows

by Calculated Risk on 3/23/2018 01:36:00 PM

Earlier from the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in February in 7 states and stable in 43 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Fifteen states had jobless rate decreases from a year earlier and 35 states and the District had little or no change. The national unemployment rate was unchanged from January at 4.1 percent but was 0.6 percentage point lower than in February 2017.

...

Hawaii had the lowest unemployment rate in February, 2.1 percent. The rates in California (4.3 percent), Maine (2.9 percent), Mississippi (4.5 percent), and Wisconsin (2.9 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Thirteen states have reached new all time lows since the end of the 2007 recession. These thirteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Kentucky, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.3%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

A few Comments on February New Home Sales

by Calculated Risk on 3/23/2018 11:34:00 AM

New home sales for January were reported at 618,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, however the three previous months were revised up.

I'd like to see data for a few more months before blaming higher interest rates, or a negative impact from the new tax law, as the cause of sluggish new home sales.

Earlier: New Home Sales at 618,000 Annual Rate in February.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 2% through February compared to the same period in 2017. Disappointing growth, but no worries - yet!

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 618,000 Annual Rate in February

by Calculated Risk on 3/23/2018 10:12:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 618 thousand.

The previous three months were revised up.

"Sales of new single-family houses in February 2018 were at a seasonally adjusted annual rate of 618,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.6 percent below the revised January rate of 622,000, but is 0.5 percent above the February 2017 estimate of 615,000. "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in February to 5.9 months from 5.8 months in January.

The months of supply increased in February to 5.9 months from 5.8 months in January. The all time record was 12.1 months of supply in January 2009.

This is at the top end of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of February was 305,000. This represents a supply of 5.9 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2018 (red column), 51 thousand new homes were sold (NSA). Last year, 51 thousand homes were sold in February.

The all time high for February was 109 thousand in 2005, and the all time low for February was 22 thousand in 2011.

This was below expectations of 626,000 sales SAAR, however the previous months were revised up. I'll have more later today.

Thursday, March 22, 2018

Friday: New Home Sales, Durable Goods

by Calculated Risk on 3/22/2018 09:59:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.1.72% increase in durable goods orders.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for 626 thousand SAAR, up from 593 thousand in January.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for February 2018

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 3/22/2018 04:28:00 PM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

Update: And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 16.4% under Mr. Trump - compared to up 44.8% under Mr. Obama for the same number of market days.

Housing Inventory Tracking

by Calculated Risk on 3/22/2018 01:45:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento, and also total existing home inventory as reported by the NAR (all through February 2018).

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory is Sacramento was up 17% year-over-year in February (still very low), and has increased year-over-year for five consecutive months. However inventory is down Nationally, and down in Phoenix and Las Vegas.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.

Kansas City Fed: Regional Manufacturing Activity "Continued at a Solid Pace" in March

by Calculated Risk on 3/22/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued at a Solid Pace

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued at a solid pace, and optimism remained high for future activity.So far all of the regional Fed surveys have been solid in March.

“Factory activity continued to grow steadily in March,” said Wilkerson. “Firms continued to report high input and selling prices and many are concerned about higher steel and aluminum tariffs.”

...

The month-over-month composite index was 17 in March, equal to 17 in February and higher than 16 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity grew modestly at durable goods plants, particularly for machinery and aircraft, while production of nondurable goods moderated slightly. Month-over-month indexes were mixed. The shipments and new orders indexes decreased moderately, while the production, order backlog, and new orders for exports indexes where basically unchanged. In contrast, the employment index edged up from 23 to 26 and the supplier delivery time index jumped from 16 to 30, both at their highest levels in survey history. The raw materials inventory index increased from 8 to 11, and the finished goods inventory index also rose modestly.

emphasis added