by Calculated Risk on 3/15/2018 11:19:00 AM

Thursday, March 15, 2018

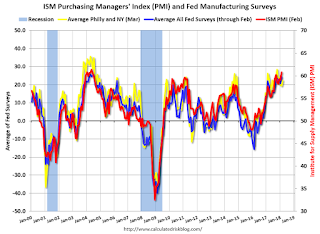

Earlier: Philly and NY Fed Manufacturing Surveys Showed Solid Growth in March

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity grew robustly in New York State, according to firms responding to the March 2018 Empire State Manufacturing Survey. The headline general business conditions index climbed nine points to 22.5. The new orders index rose to 16.8 and the shipments index advanced to 27.0—readings that pointed to strong growth in orders and shipments. Unfilled orders increased, delivery times lengthened, and inventories edged higher. Labor market indicators showed an increase in employment and hours worked. After reaching a multiyear high last month, the prices paid index moved up further, reflecting ongoing and widespread increases in input prices. The prices received index held steady and suggested moderate selling price increases. Firms remained optimistic about future business conditions, though less so than last month, and capital spending plans remained strong.And from the Philly Fed: March 2018 Manufacturing Business Outlook Survey

Results from the March Manufacturing Business Outlook Survey suggest continued growth for the region’s manufacturing sector. ... The diffusion index for current general activity remained positive but declined, from 25.8 in February to 22.3 this month ... The firms continued to report increases in employment. Nearly 35 percent of the responding firms reported increases in employment, while 9 percent reported decreases this month. The current employment index edged slightly higher to 25.6, its highest reading in five months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

This suggests the ISM manufacturing index will show solid expansion again in March.