by Calculated Risk on 4/30/2018 04:21:00 PM

Monday, April 30, 2018

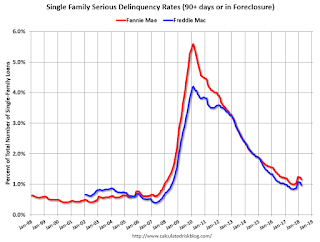

Fannie Mae: Mortgage Serious Delinquency rate decreased in March

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 1.16% in March, down from 1.22% in January. The serious delinquency rate is up from 1.12% in March 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 3.24% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 6.22% are seriously delinquent, For recent loans, originated in 2009 through 2018 (91% of portfolio), only 0.51% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, the rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.