by Calculated Risk on 8/16/2018 11:01:00 AM

Thursday, August 16, 2018

Comments on July Housing Starts

Earlier: Housing Starts at 1.168 Million Annual Rate in July

Housing starts in July were disappointing once again, and starts for May and June were revised down. However this was just the second month of disappointing starts, and most of the decline was in multi-family starts that are volatile month-to-month.

The housing starts report released this morning showed starts were up 0.9% in July compared to June (only up because June was revised down), and starts were down 1.4% year-over-year compared to July 2017.

Multi-family starts were down 9.6% year-over-year, and single family starts were up 2.7% year-over-year.

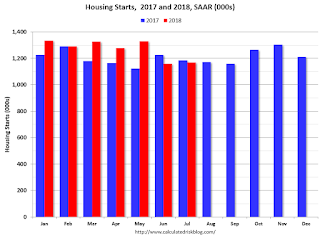

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were down 1.4% in July compared to July 2017.

Through seven months, starts are up 6.2% year-to-date compared to the same period in 2017. Even with the weakness over the last two months, that is still a decent increase.

Single family starts were up 2.7% year-over-year, and up 0.9% compared to July 2018.

Multi-family starts were down 9.6% year-over-year, and up 3.1% compared to June 2018 (multi-family is volatile month-to-month).

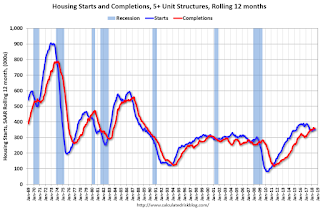

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but has turned down recently. Completions (red line) had lagged behind - however completions have passed starts (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significantly growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a couple more years, or more, of increasing single family starts and completions.

Note: Last month, in response to numerous articles discussing the "slowing housing market" and some suggesting "housing has peaked", I wrote: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2). My view currently remains the same, but if the weakness in housing starts and new home sales persist, I'll revisit my outlook. My guess is the weakness will not continue, and new home sales and single family starts will increase further.