Two key points:

1) This is a reasonable level for existing home sales, and doesn't suggest any significant weakness in housing or the economy. The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

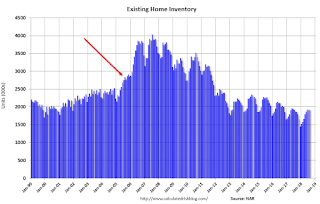

2) Inventory is still very low, but was up 2.7% year-over-year (YoY) in August. This was the first year-over-year increase since May 2015. (Note: Inventory for June was initially reported as up slightly year-over-year, but inventory was revised down).

Click on graph for larger image.

Click on graph for larger image.The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase significantly and still be at normal levels. No worries.

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The second graph shows existing home sales Not Seasonally Adjusted (NSA).Sales NSA in August (539,000, red column) were slightly above sales in August 2017 (535,000, NSA).

Sales NSA through August (first eight months) are down about 1.2% from the same period in 2017.

This is a small YoY decline in sales to-date - but it is possible there has been an impact from higher interest rates and / or the changes to the tax law (eliminating property taxes write-off, etc).