by Calculated Risk on 9/26/2018 11:59:00 AM

Wednesday, September 26, 2018

A few Comments on August New Home Sales

New home sales for August were reported at 629,000 on a seasonally adjusted annual rate basis (SAAR). This was close to the consensus forecast, however the three previous months were revised down significantly.

Sales in August were up 12.7% year-over-year compared to August 2017. This was strong YoY growth, however this was an easy comparison since new home sales were soft in mid-year 2017.

On Inventory: Months of inventory is now close to the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch.

Earlier: New Home Sales increase to 629,000 Annual Rate in August.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Note that new home sales have been up year-over-year every month this year (so far).

Sales are up 6.9% through August compared to the same period in 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors. And new home sales had a strong last few months in 2017, so the comparisons will be more difficult.

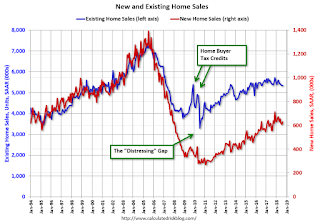

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.